Warren Buffett says this book changed his life forever. Here's the real key to long-term gains

Moby’s team spends hundreds of hours sifting through financial news and data to provide you with stock and crypto reports delivered straight to you. Their research keeps you up-to-the-minute on market shifts and can help you reduce the guesswork behind choosing stocks and ETFs.

Plus, their reports are easy to understand for beginners, so you can become a smarter investor in just five minutes.

Trust the experts

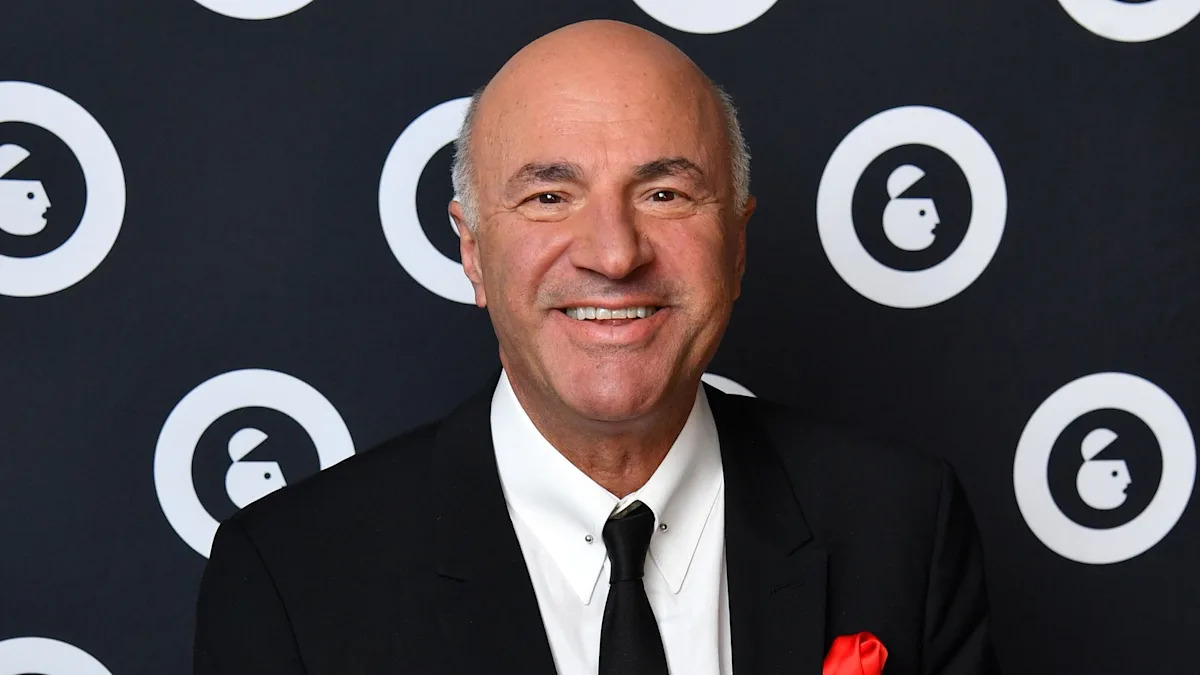

Aside from doing your own research, it can pay to invest in professional advice.

Even Buffett surrounded himself with knowledgeable advisors at Berkshire Hathaway. Everyone has areas of expertise, but no one knows everything.

With this in mind, an expert advisor can help you raise your game. As Buffett once said, “Pick out associates whose behavior is better than yours and you’ll drift in that direction.”

“In looking for people to hire, you look for three qualities: integrity, intelligence, and energy. And if they don't have the first, the other two will kill you.”

If you’re unsure which path to take amid today’s market uncertainty, it might be a good time to connect with a financial advisor through Advisor.com.

This online platform connects you with vetted financial advisors best suited to help you develop a plan for your new wealth.

Just answer a few quick questions about yourself and your finances and the platform will match you with an experienced financial professional. You can view their profile, read past client reviews, and schedule an initial consultation for free with no obligation to hire.

You can view advisor profiles, read past client reviews, and schedule an initial consultation for free with no obligation to hire.

Read more: Rich, young Americans are ditching the stormy stock market — here are the alternative assets they're banking on instead

A ‘set it and forget it’ approach

While keen investors may be willing to spend the time to learn the markets, many investors can be better off with a passive approach.

"In my view, for most people, the best thing to do is own the S&P 500 index fund,” Buffett once said.

"The trick is not to pick the right company. The trick is to essentially buy all the big companies through the S&P 500 and to do it consistently and to do it in a very, very low-cost way.”

A passive approach might not produce spectacular wins, but it can be a low-risk option for the investor who is simply looking to build a reliable nest egg for retirement.

What to read next

-

How much cash do you plan to keep on hand after you retire? Here are 3 of the biggest reasons you'll need a substantial stash of savings in retirement

-

5 simple ways to grow rich with US real estate — without the headaches of being a landlord. Start now with as little as $10

-

This tiny hot Costco item has skyrocketed 74% in price in under 2 years — but now the retail giant is restricting purchases. Here’s how to buy the coveted asset in bulk

-

Financial aid only funds about 27% of US college expenses — but savvy parents are using this 3-minute move to cover 100% of those costs

Stay in the know. Join 200,000+ readers and get the best of Moneywise sent straight to your inbox every week for free. Subscribe now.

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.

Content Original Link:

" target="_blank">