Here’s the Minimum Net Worth To Be Considered the Top 1% in Your 50s

If you hear someone say they’re in the top 1% for net worth, it just means their household has more wealth than 99% of others in that same age bracket. Net worth means everything you own (cash, investments, home equity, business stakes, etc.) minus what you owe (mortgages, loans, credit cards).

Learn More: What Is the Estimated Median Income for the Upper-Middle Class in 2025?

For You: 7 Tax Loopholes the Rich Use To Pay Less and Build More Wealth

High net worth people have typically saved and invested over decades and often benefited from things like home-price gains or business exits. Let’s explore the minimum net worth threshold to be considered in the top 1% for those in their 50s, the factors that influence it and what it might mean for financial planning.

Aiming more for upper class? Here’s the minimum net worth needed to reach that class.

Defining ‘Top 1% Net Worth’ for Your 50s

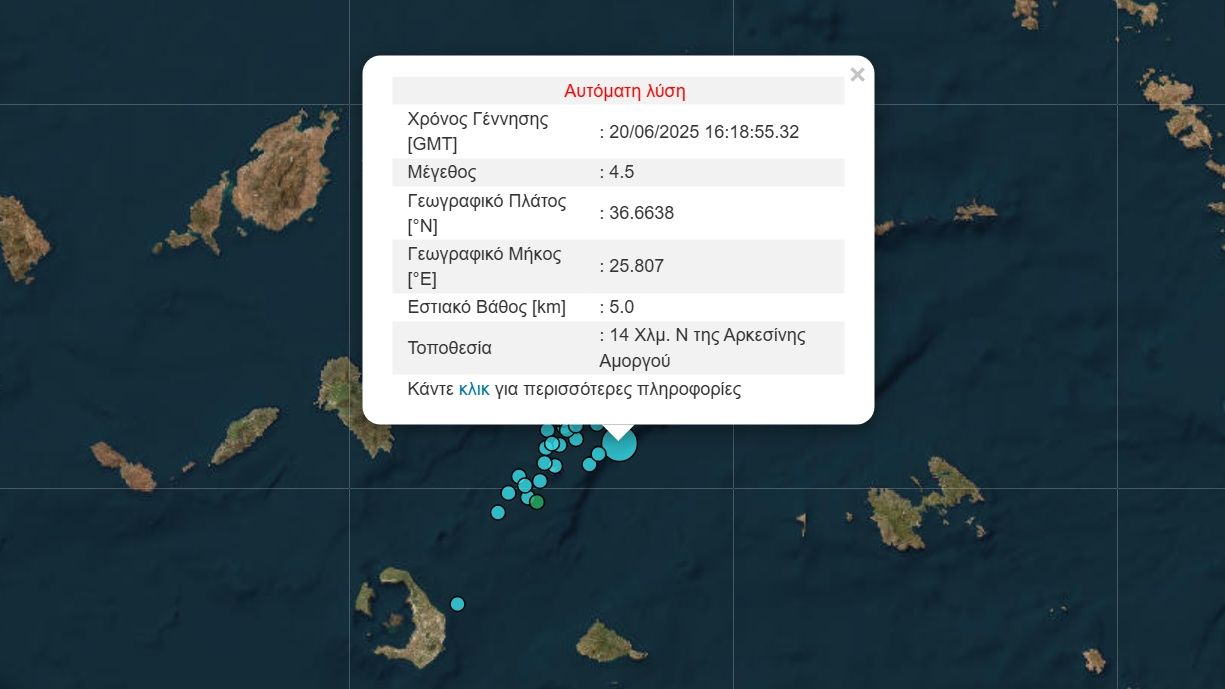

Based on the Federal Reserve’s 2022 Survey of Consumer Finances and modeling of the highest net worths, estimates for 2023 show:

-

Ages 50 to 54: About $13.23 million net worth to be in the top 1% of that age group.

-

Ages 55 to 59: About $15.37 million net worth for the top 1%.

These figures come from a site (DQYDJ) that uses the Fed data plus statistical methods to estimate the “upper tail,” where very-high-net-worth households live. Treat them as rough benchmarks though and not exact cutoffs.

Read Next: Warren Buffett’s Top 4 Tips for Getting Richer

Factors Influencing Net Worth Accumulation by Your 50s

Several factors determine where someone lands relative to these thresholds. Investment performance over decades significantly impacts wealth growth as the market does fluctuate but tends to go up over time.

Business equity can play a major role in providing the income and necessary opportunities to accumulate such a high net worth. Owners who have scaled and perhaps exited companies often see net worth jump into higher percentiles. And let’s also not forger that family wealth transfers can accelerate reaching top net worth brackets.

Here are some other key factors to keep in mind:

-

Time to Grow Assets: By your 50s, decades of saving and investing can compound, especially if you started early.

-

Home Values: Long-term homeowners in markets that rose significantly see big equity gains.

-

Inheritance or Gifts: Family transfers can accelerate reaching high net worth for some.

-

Debt Management: Staying out of high-interest debt frees more money to save/invest.

Because very few households ever reach $13M+ by their early 50s, hitting this level usually requires high earnings, disciplined saving, favorable market conditions, or business/inheritance windfalls.

Content Original Link:

" target="_blank">