Buy Texas Instruments (TXN) for its Innovation and Steady Dividend Income

Texas Instruments Incorporated (NASDAQ:TXN) is included among the 11 Innovative Dividend Stocks to Buy Now.

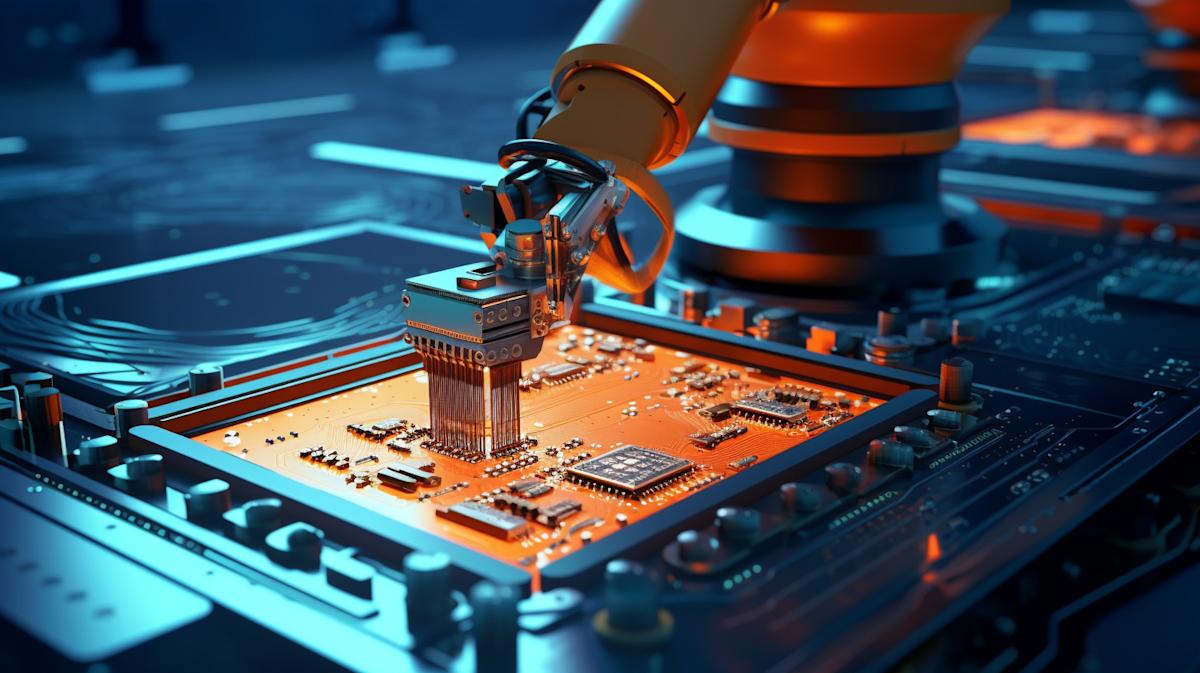

A robotic arm in the process of assembling a complex circuit board - showing the industrial scale the company operates at.

Texas Instruments Incorporated (NASDAQ:TXN) is an American global semiconductor company known for manufacturing analog and embedded chips. In 1954, it made history by developing the first commercial silicon transistor, a major advancement that helped reshape the electronics industry. The company was also among the pioneers in integrated circuit technology, commonly known as microchips, which played a key role in making electronic devices more compact and driving progress in computing and communication. In 1967, Texas Instruments also introduced the TI-2500, the first handheld electronic calculator.

Texas Instruments Incorporated (NASDAQ:TXN) reported strong earnings in the second quarter of 2025. The company posted revenue of $4.45 billion, up 16.4% from the same period last year. The revenue also beat analysts’ estimates by $132.8 million.

Texas Instruments Incorporated (NASDAQ:TXN) reported operating cash flow of $6.4 billion over the past 12 months, highlighting the resilience of its business model, the strength of its product lineup, and the advantages gained from 300mm production. During the same period, free cash flow reached $1.8 billion. The company returned $1.2 billion to shareholders through dividends. Currently, it offers a quarterly dividend of $1.36 per share and has a dividend yield of 2.87%, as of July 28.

While we acknowledge the potential of TXN as an investment, we believe certain AI stocks offer greater upside potential and carry less downside risk. If you're looking for an extremely undervalued AI stock that also stands to benefit significantly from Trump-era tariffs and the onshoring trend, see our free report on thebest short-term AI stock.

READ NEXT: 10 Best and Safe Dividend Stocks to Buy Now and 10 Stocks with Highest Dividend to Buy Right Now.

Disclosure: None.

Content Original Link:

" target="_blank">