Bitcoin Diamond Hands Are Buying Again, Here’s Why It’s Bullish For The Market

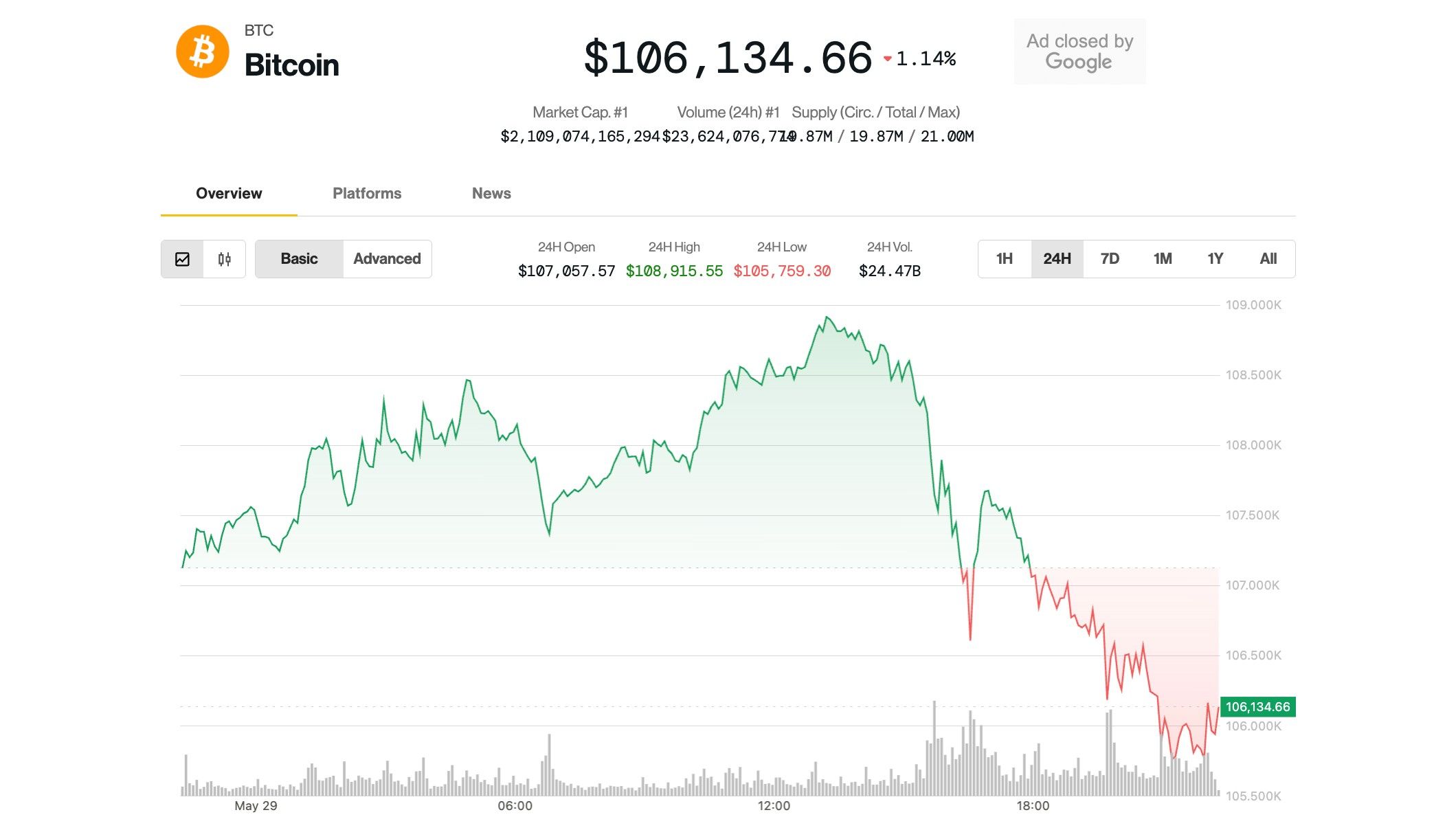

Bitcoin has spent the last five days trading within a relatively narrow range between $106,229 and $111,807, following its recent all-time high of $111,814. Despite the increase in selling pressure from miners after the all-time high, the price of Bitcoin has managed to hold above $108,000, with on-chain data showing Bitcoin diamond hands absorbing all the selling pressure.

Long-Term Holders Accumulating With Minimal Spending

According to data from the on-chain analytics platform CryptoQuant, the Long-Term Holder (LTH) Spending Binary Indicator has fallen to its lowest level since September 2024. This interesting trend was initially noted on the social media platform X by crypto analyst Alex Adler Jr.

The 15-day moving average of this metric, as shown in the chart by CryptoQuant, has dropped to the minimal spending zone. Notably, this zone has consistently preceded a more bullish move in the Bitcoin price.

In parallel, long-term holder supply has risen by approximately 300,000 BTC over the past 20 days. This marks a deviation from the trend of declines in the long-term holder supply since 2024. At the time of writing, 14.6 million BTC, representing about 74% of the total current circulating supply of BTC, is in addresses classified as long-term holders.

This pattern suggests that so-called “diamond hands”, i.e., investors with a strong conviction who hold through volatility, are not only refraining from selling with Bitcoin’s recent new peak, but are actively accumulating. The chart below shows the correlation between minimal LTH spending and rising price action, a behavior that also aligned with phases of Bitcoin’s uptrend in 2019, late 2020, and late 2024.

Why It’s Bullish For The Market

The significant uptick in long-term holder supply, combined with minimal selling activity, reveals a hidden strength in the market. The current behavior of long-term investors also indicates their confidence in Bitcoin’s valuation at current levels, despite the recent price surge. Many of these long-term holders are in substantial profit, yet still choose to hold. This is unlike short-term holders, who have collectively realized over $11.6 billion in profits over the past month alone.

Drawing a parallel with historical data, the current decline in long-term holder (LTH) spending mirrors a similar pattern observed in September 2024. At that time, the LTH Indicator was in the minimal zone, and the long-term holder supply was also increasing steadily.

What followed was a remarkable 96% surge in Bitcoin’s price, rising from approximately $54,000 to peaks around $106,000 in December and January. If the market were to follow a similar trajectory from the current price level, a comparable 96% rally would see Bitcoin rise to a new peak near $212,000.

At the time of writing, Bitcoin is trading at $109,000.

Content Original Link:

" target="_blank">