Trump Media Plunges 13% Despite $2.5B Bitcoin Treasury Play: Market Questions Bold Crypto Pivot

Market Capitalization Impact: Strategy’s market value reached nearly $94 billion, demonstrating how bitcoin holdings can dramatically amplify a company’s valuation beyond its core operating business.

Emerging Trend: Companies, including GameStop (NYSE:GME) and various biotech firms, have attempted to replicate this success, though with mixed results.

Analyzing Trump Media’s Position

Current Financial Foundation

Trump Media brings several advantages to this strategy:

-

Cash Position: $759 million in existing cash and short-term investments provides a solid foundation

-

Custody Infrastructure: Partnerships with Anchorage Digital and Crypto.com ensure institutional-grade security

-

Political Alignment: The company benefits from the Trump administration’s pro-crypto stance

Strategic Rationale

CEO Devin Nunes framed the investment as acquiring “crown jewel assets consistent with America First principles,” positioning bitcoin as an “apex instrument of financial freedom.” This messaging aligns perfectly with the current administration’s digital asset embrace and could resonate with the company’s target demographic.

Risk Factors to Consider

Execution Risk: Unlike MicroStrategy which has years of experience managing large bitcoin positions, Trump Media is new to crypto treasury management.

Business Model Diversification: The company is simultaneously pursuing financial services expansion, M&A opportunities, and various crypto ventures, potentially spreading focus thin.

Regulatory Exposure: Heavy bitcoin positioning creates vulnerability to potential regulatory changes, despite current favorable conditions.

Market Confidence: The immediate 13% decline suggests investors may be questioning whether Trump Media can successfully execute this complex strategy or whether the valuation premium is justified.

Trending: New to crypto?Get up to $400 in rewards for successfully completing short educational courses and making your first qualifying tradeon Coinbase.

Market Context and Timing

Current Crypto Environment

The timing appears strategically sound from a macro perspective:

-

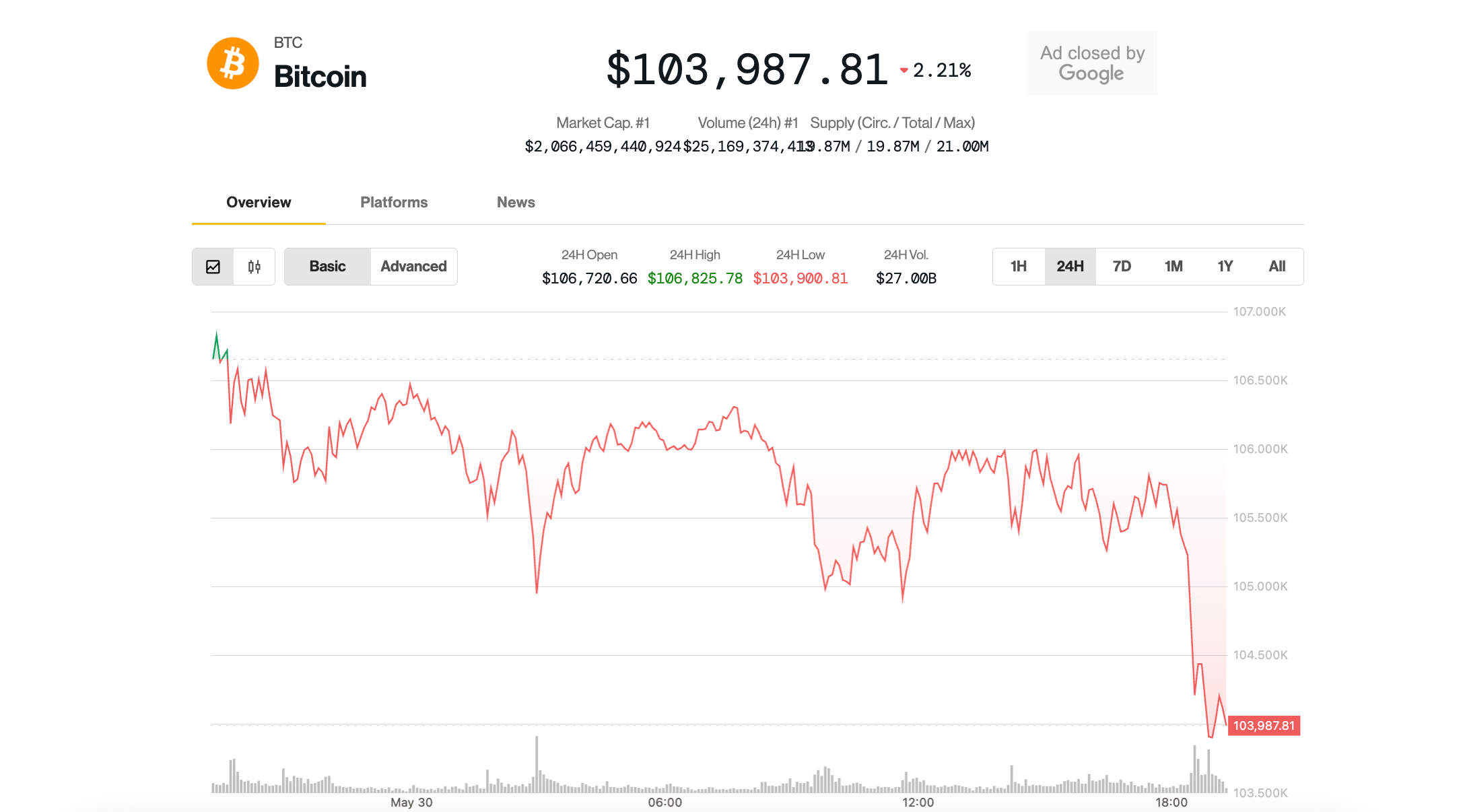

Bitcoin recently achieved new all-time highs above $111,000

-

Institutional adoption continues accelerating

-

Regulatory environment under Trump administration remains crypto-friendly

-

Corporate treasury adoption gaining mainstream acceptance

Competitive Landscape

The announcement of Twenty One Capital – valued at $3.6 billion – through Cantor Fitzgerald, Tether, and demonstrates continued institutional interest in bitcoin-focused investment vehicles. This validates the thesis that bitcoin treasury strategies can attract significant capital.

Investment Implications

For DJT Shareholders

Potential Upside:

-

Leveraged exposure to bitcoin price appreciation

-

Multiple expansion similar to MicroStrategy’s experience

-

First-mover advantage in politically aligned crypto investing

Key Risks:

-

Bitcoin volatility could dramatically impact share price

-

Execution risk from management team without crypto experience

-

Potential dilution from the equity raise

-

Market skepticism evidenced by the 13% decline suggests investors remain unconvinced about the strategy’s merit

Broader Market Impact

This move reinforces several important trends:

-

Corporate bitcoin adoption becoming standard practice for certain company types

-

Political alignment increasingly influencing investment strategies

-

Traditional revenue diversification giving way to balance sheet diversification

Strategic Assessment

Trump Media’s bitcoin strategy appears well-timed and properly structured, but success will depend on execution and market conditions. The company benefits from favorable political winds and proven demand for bitcoin-leveraged equity exposure.

However, the immediate 13% stock drop from suggests the market views this as a high-risk transformation that may not justify current valuations. Investors should recognize this as a high-risk, high-reward play that transforms Trump Media into a bitcoin proxy with social media operations attached.

Looking Forward

Key factors to monitor:

-

Bitcoin price performance and its impact on DJT’s market valuation

-

Successful deployment of the $2.5 billion into bitcoin positions

-

Integration of crypto strategy with existing business operations

-

Market confidence recovery following the initial 13% decline

-

Regulatory developments that could impact crypto-heavy corporate strategies

Ending Thoughts

Trump Media’s bitcoin bet represents a calculated attempt to replicate MicroStrategy’s success while leveraging political alignment and timing. However, the immediate market reaction suggests significant investor skepticism about execution risk and valuation concerns.

While the strategy has proven successful elsewhere, the market’s negative response indicates investors must weigh the potential for extraordinary returns against substantial execution risks and dilution concerns. The move signals continued mainstream adoption of corporate bitcoin strategies, but Trump Media’s individual success will depend on management execution, market timing, and the company’s ability to restore investor confidence while managing a complex transformation from social media company to diversified financial services and crypto investment vehicle.

For investors, this represents a leveraged bet on both bitcoin appreciation and Trump Media’s ability to overcome market skepticism while executing one of the most ambitious corporate treasury transformations in recent memory.

Read Next:

-

A must-have for all crypto enthusiasts: Sign up for the Gemini Credit Card today and earn rewards on Bitcoin Ether, or 60+ other tokens, with every purchase.

-

‘Scrolling To UBI' — Deloitte's #1 fastest-growing software company allows users to earn money on their phones. You can invest today for just $0.30/share with a $1000 minimum.

Image: Shutterstock

Send To MSN: 0

This article Trump Media Plunges 13% Despite $2.5B Bitcoin Treasury Play: Market Questions Bold Crypto Pivot originally appeared on Benzinga.com

Content Original Link:

" target="_blank">