Saylor's bitcoin buying strategy is 'exploding' globally, but Wall Street is skeptical

Vice President JD Vance this week became the first sitting vice president to address the bitcoin community directly, framing crypto as a hedge against inflation, censorship, and "unelected bureaucrats." And in a further move to boost bitcoin, the Department of Labor rolled back guidance that had discouraged bitcoin investments in retirement plans.

"No force on Earth can stop an idea whose time has come," Saylor said. "Bitcoin is digital capital and maybe the most explosive idea of the era."

Some corners of the corporate world are still resistant. Late last year, Microsoft shareholders rejected a proposal to use some of the software company's massive cash pile to follow Saylor's lead. In a video presentation supporting the effort, Saylor told investors that "Microsoft can't afford to miss the next technology wave."

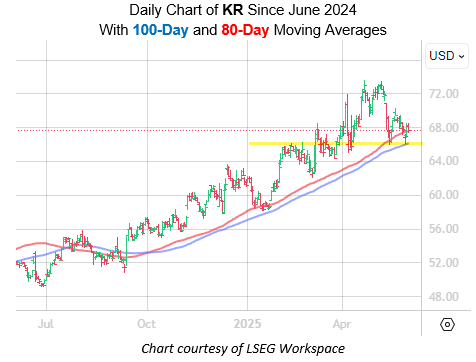

While Strategy has reaped the rewards of early adoption, Saylor suggested the market's cooler reaction to Trump Media and GameStop may stem more from structural financing dynamics than from skepticism toward bitcoin itself.

He pointed to GameStop's initial announcement that it was considering a bitcoin strategy, which led to a 50% pop in the stock and tenfold increase in trading volume. The company quickly capitalized on the momentum with a $1.5 billion convertible bond raise — a move he described as "extraordinarily successful." Trump Media took a similar approach, raising capital through a large convertible bond offering.

Saylor said those financing methods can create short-term downward pressure, but that over time investors will benefit.

When it comes to Strategy, Saylor said there's no ceiling to his bitcoin accumulation plans. His company is already by far the largest corporate holder of the cryptocurrency.

"We'll keep buying bitcoin," he told CNBC. "We expect the price of bitcoin will keep going up. We think it will get exponentially harder to buy bitcoin, but we will work exponentially more efficiently to buy bitcoin."

For critics who worry that state and media actors embracing bitcoin will undermine its decentralized ideals, Saylor argues the opposite.

"The network is very anti-fragile, and there's a balance of power here," he said. "The more actors that come into the ecosystem, the more diverse, the more distributed the protocol is, the more incorruptible it becomes, the more robust it becomes, and so that means the more trustworthy it becomes to larger economic actors who otherwise would be afraid to put all of their economic weight on the network."

WATCH:Bitcoin heads for winning month despite return of trade war fears: CNBC Crypto World

Content Original Link:

" target="_blank">