Bitcoin Price (BTC) Analysis: Drop in Leveraged Longs on Bitfinex Could Mean Rally

Those who have followed financial markets for some time may have heard of contrary indicators. These metrics are often misleading at first glance – some appear positive but tend to signal a market downtrend, while others that seem negative mark price upswings.

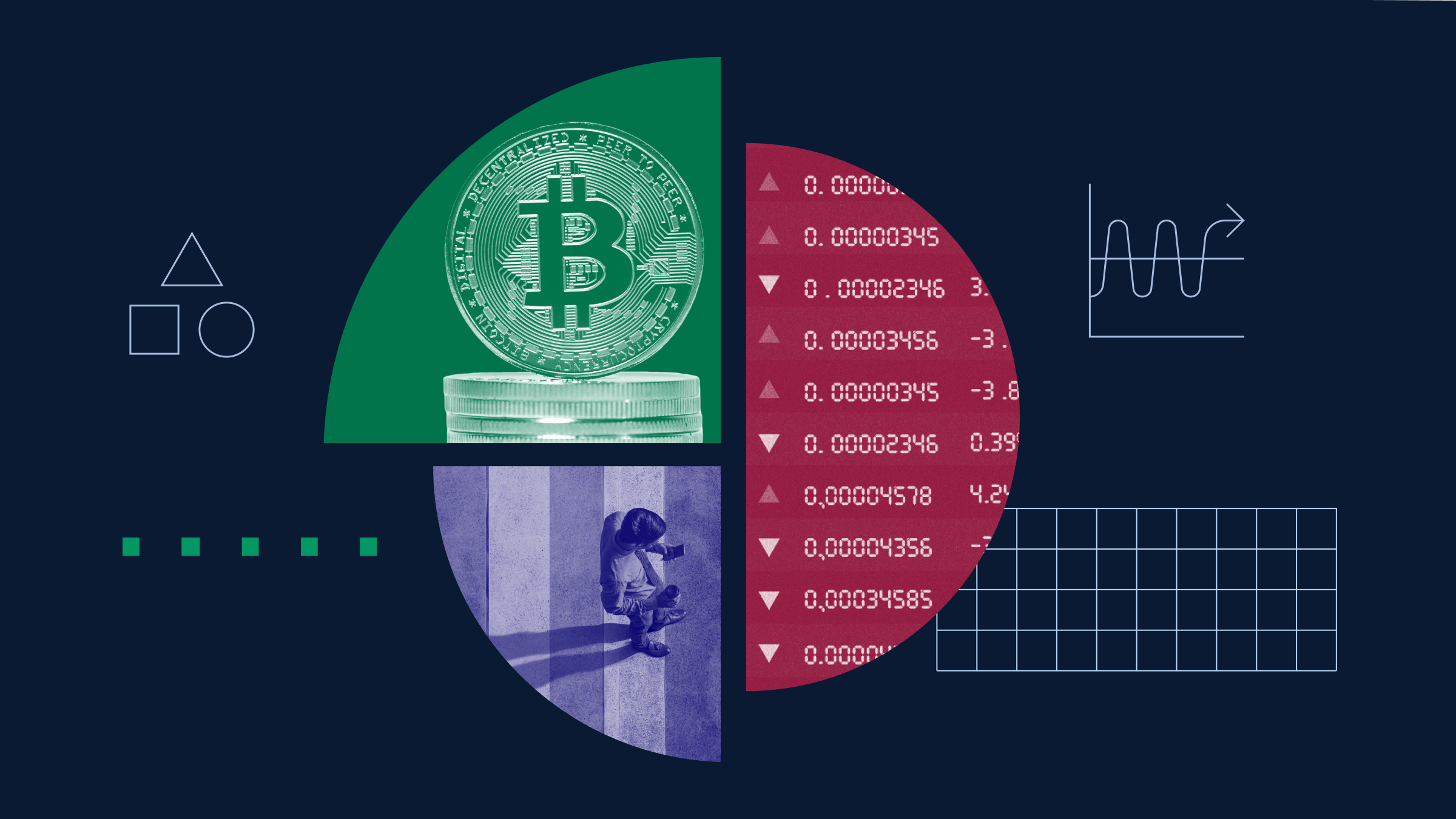

One such contrary indicator is leveraged bitcoin longs on the crypto exchange Bitfinex. Historically, the number of leveraged longs on the exchange has tended to slide during bull runs and rise during bearish trends.

As of writing, the number of BTCUSD longs on Bitfinex had fallen to 47,691, the lowest since December, offering bullish cues for bitcoin, according to data source TradingView. The tally of longs peaked in the first half of April and has been declining since then, characterizing BTC's rapid recovery from around $75K to record highs of over $110K.

"When Bitfinex Long Positions rise, the price tends to fall. When Long Positions drop, the price usually goes up," crypto analytics firm Alphractal said on X.

Explaining the conundrum, Alphractal said that traders are typically wrong about the market direction. That leads to forced or discretionary liquidations, which drive the price in the opposite direction.

"As long as Bitfinex Long Positions keep dropping, Bitcoin will continue to rise," João Wedson, CEO of Alphractal, noted.

The chart shows the contrary nature of the BTCUSD longs on Bitfinex.

Since 2021, every major BTC rally, including those seen in November-December last year and the latest one from early April lows, has coincided with the slide in BTCUSD longs on the exchange.

On the other hand, BTC's bear trends, including the 2022 crash and the decline from $100K to $75K seen early this year, occurred as BTC/USD longs surged.

Content Original Link:

" target="_blank">