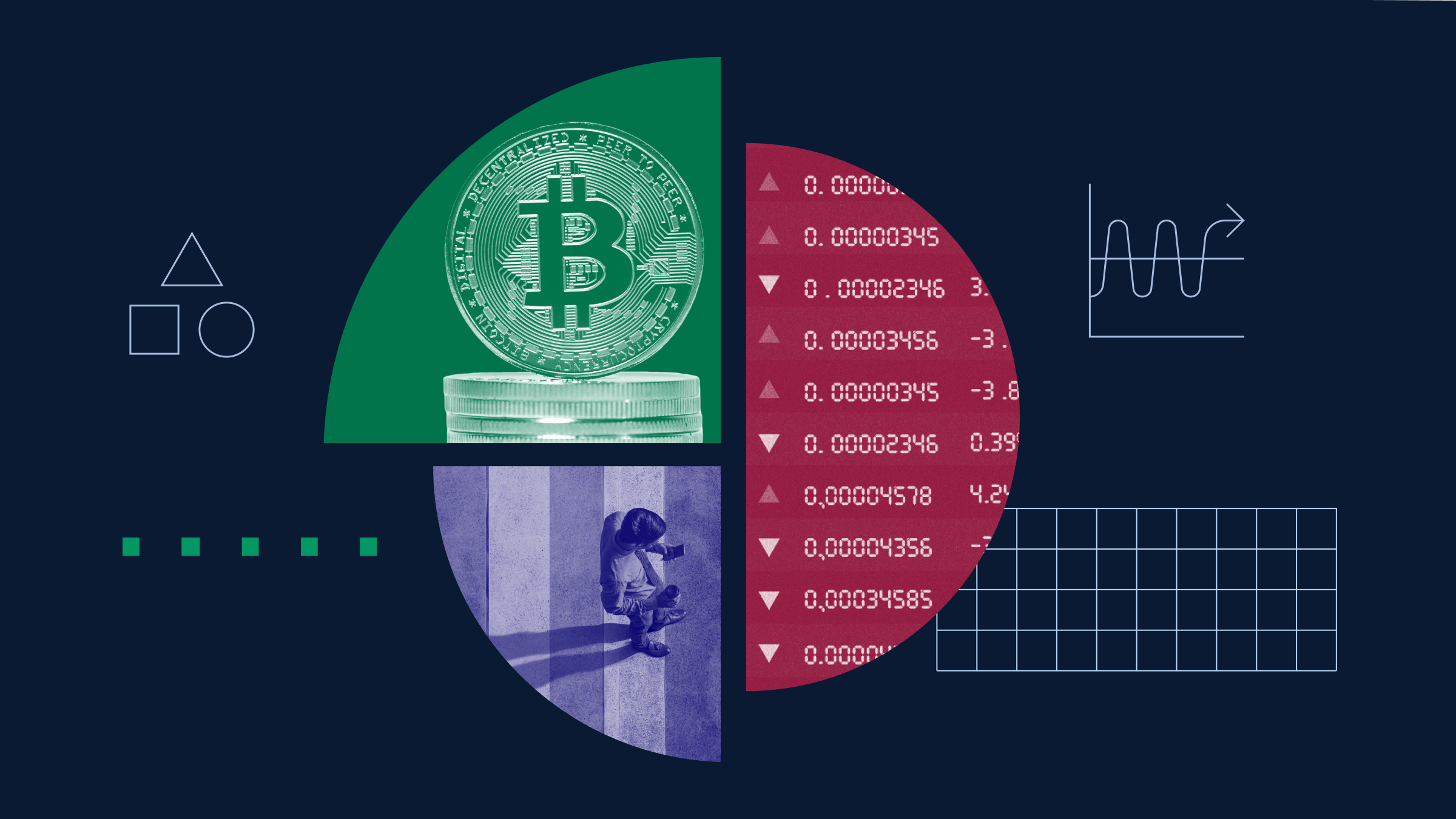

Corporate Bitcoin Holdings Top 800K BTC After More Than Doubling in a Year

Bitcoin

has taken deeper root in corporate treasuries, with 116 public companies now holding a combined 809,100 BTC, worth around $85 billion based on current prices, at the end of May.That’s a dramatic rise from 312,200 BTC held a year ago in corporate treasuries, according to Binance Research’s latest report. Nearly 100,000 BTC has been added since early April alone.

The surge appears driven by a mix of rising prices and structural tailwinds. Donald Trump adopted a pro-crypto stance during his 2024 presidential campaign, vowing to make the U.S. a global hub for the asset class and create a “crypto capital of the planet.”

Since Trump took office he has moved to establish a Strategic Bitcoin Reserve and a U.S. Digital Asset Stockpile, while the U.S. Securities and Exchange Commission has dropped numerous lawsuits against major crypto firms..

Binance’s report shows that bitcoin treasury accumulation grew in November, when Trump won the election.

Adding to that, new fair-value accounting rules introduced by the Financial Account Standards Board (FASB) this year allow companies to recognize gains on BTC holdings, removing a longstanding deterrent.

Newer entrants including GameStop (GME) and PSG have recently started accumulating BTC as a well, yet Strategy still holds the lion’s share of BTC in corporate treasuries, with over 70% of holdings.

Some companies are also tiptoeing into other assets. SharpLink holds $425 million in ETH, while DeFi Development and Classover are betting on solana

. China-based firm Webus recently filed for a $300 million strategic reserve.Still, these altcoin holdings remain relatively small and are often tied to firms trying to rebrand as token-forward entities, Binance noted.

Binance’s report also flagged the rapid rise of tokenized real-world assets (RWAs), which have climbed more than 260% from $8.6 billion to $23 billion this year.

Content Original Link:

" target="_blank">