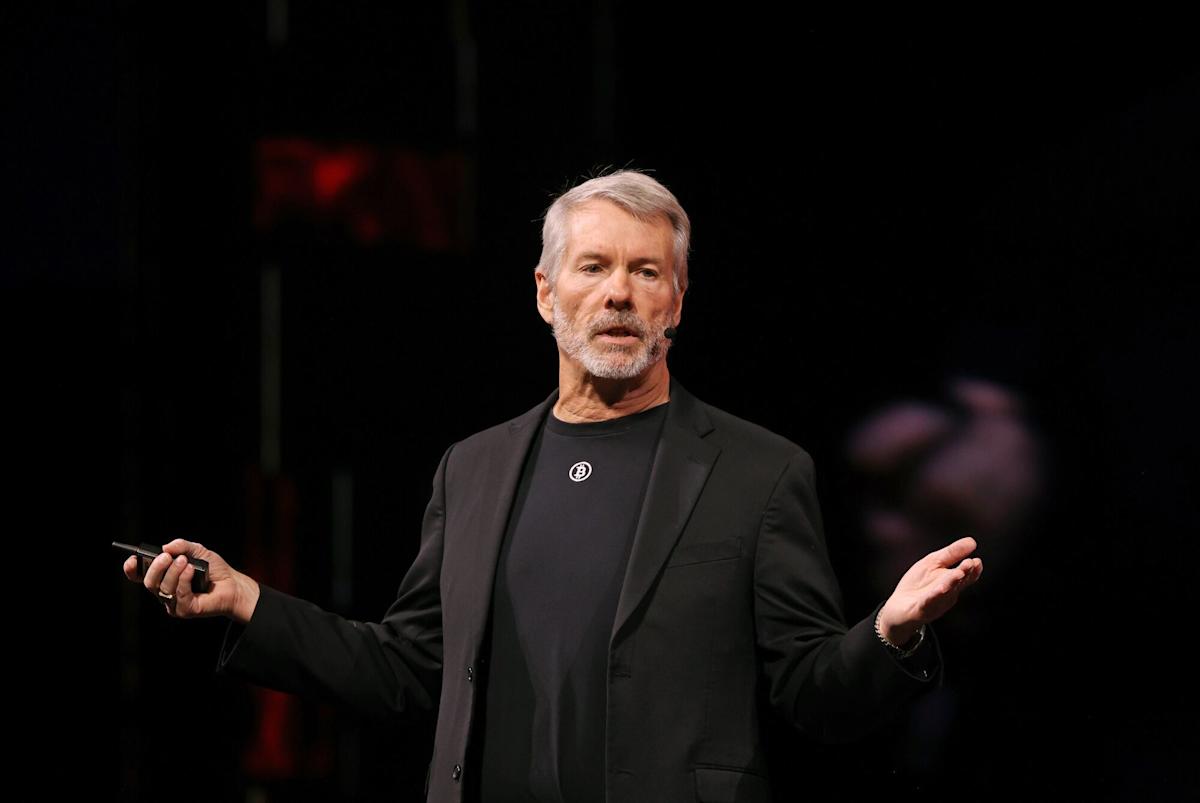

Michael Saylor Amps Up Bitcoin War Chest With $2.8 Billion Sale

(Bloomberg) -- Michael Saylor’s one-of-a-kind capital markets machine just got bigger.

Most Read from Bloomberg

-

Trump Awards $1.26 Billion Contract to Build Biggest Immigrant Detention Center in US

-

The High Costs of Trump’s ‘Big Beautiful’ New Car Loan Deduction

-

Salt Lake City Turns Winter Olympic Bid Into Statewide Bond Boom

As crypto prices continue to boom, Saylor’s Bitcoin holding company, Strategy launched a new kind of preferred stock, and then promptly upsized the deal from $500 million to $2.8 billion, according to a person familiar with the transaction who asked not to be identified.

The security that priced on Thursday, which the company is calling Stretch, promises buyers a hefty 9% annual payout, with no end date attached — unusual in the arcane world of preferred stock offerings.

The deal offered the latest demonstration of Saylor’s Wall Street wizardry as he continues his years-long effort to transform a middling software firm, which used to be known as MicroStrategy, into a financial juggernaut obsessed with one goal: raising as much money as possible to acquire as many Bitcoin as possible. Some 600,000 coins, or around $70 billion worth at last count.

“This is not the first financial engineering initiative by Strategy,” said Campbell Harvey, a professor at Duke University. “In any situation where your company is worth far more than fundamental value, you raise money.”

Since Strategy’s first purchase in 2020, Saylor has sold equity, issued various types of debt and layered stacks of preferred shares on top. In the process, he has encouraged a fleet of imitators and spurred a new industry of public companies following a so-called treasury strategy dedicated to buying and holding cryptocurrencies.

Many of the previous financial instruments that have fueled Strategy’s rise have ended up being more popular than expected, but even against that backdrop the demand for Stretch was notable. The company’s common shares rose 0.5% on Wednesday, and are up 43% for the year.

In Strategy’s complicated and unusual capital structure, the new shares sit above the company’s common stock and its other preferred shares — which carry names like “Strike” and “Stride” — but remain subordinate to its convertible bonds and a preferred stock known as “Strife.”

Unlike those earlier offerings, Stretch allows Strategy to tweak the dividend. Each month, the firm will set a new payout rate aimed at keeping the share price near $100, raising or lowering the level as needed. It’s part pricing model, part trust exercise, and a clear reminder that Strategy creates its own rules.

Content Original Link:

" target="_blank">