This Bitcoin Price Prediction Suggests BTC Will Hit $200K in 2025

Bitcoin (BTC)price prediction just got a major institutional backing as Citigroup analystsreveal their bold forecast for the world's largest cryptocurrency. With Bitcointrading around $118,700, the banking giant's latest analysis provides crucialinsights into why Bitcoin price continues its relentless climb toward newheights.

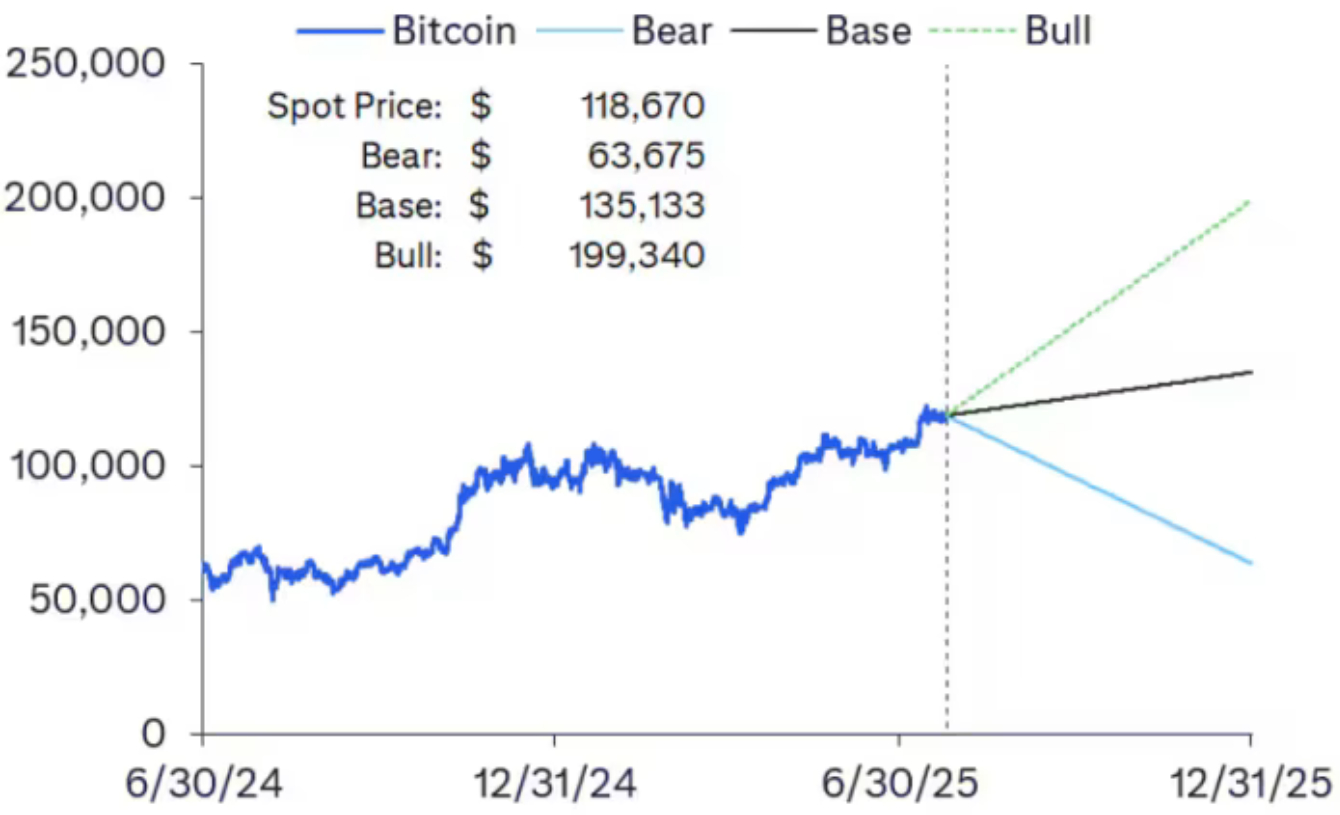

Citigroupanalysts Alex Saunders and Nathaniel Rupert have released comprehensive Bitcoinprice predictions that showcase dramatically different scenarios for thecryptocurrency's future. Their base case target of $135,133 represents asignificant upside from current levels, while their bull case soars to $199,340by year-end.

Theanalysts' approach represents a fundamental shift in how traditional financialinstitutions view Bitcoin price dynamics. Rather than dismissing cryptocurrencymarkets as isolated speculation, Citi now recognizes Bitcoin's integration intomainstream financial infrastructure.

"Cryptoassets have grown and now represent a more meaningful amount of capital,"the analysts note. "Crypto market-caps now rival all but the largest-capequity names."

It's worthnoting that Citi is not alone in its projections. As early as mid-February, FinanceMagnates.comwrote that Antoni Skaramoty's analysis had gained attention on Bridge Capital, whichalso suggested Bitcoin could reach $200,000, potentially even this year.Notably, that forecast emerged when Bitcoin had yet to break above the $100,000mark. Aroundthe same time, VanEck projected that Bitcoin could rise to $180,000.

ETF Flows Drive BitcoinPrice Action

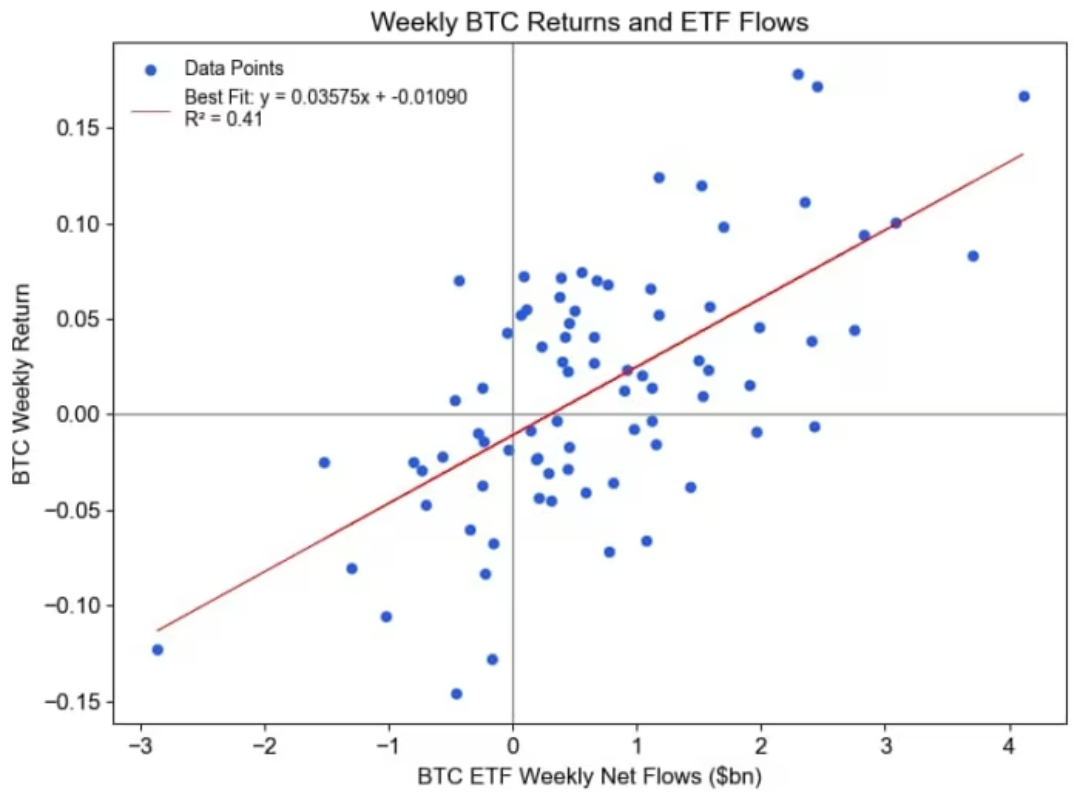

The moststriking revelation from Citi's analysis centers on exchange Exchange An exchange is known as a marketplace that supports the trading of derivatives, commodities, securities, and other financial instruments.Generally, an exchange is accessible through a digital platform or sometimes at a tangible address where investors organize to perform trading. Among the chief responsibilities of an exchange would be to uphold honest and fair-trading practices. These are instrumental in making sure that the distribution of supported security rates on that exchange are effectiv An exchange is known as a marketplace that supports the trading of derivatives, commodities, securities, and other financial instruments.Generally, an exchange is accessible through a digital platform or sometimes at a tangible address where investors organize to perform trading. Among the chief responsibilities of an exchange would be to uphold honest and fair-trading practices. These are instrumental in making sure that the distribution of supported security rates on that exchange are effectiv Read this Term-traded fund flowsas the primary driver behind Bitcoin's recent price surge. The researchdemonstrates that 41% of Bitcoin return variation can be explained by ETF flowsalone since the products launched.

Thisrelationship proves remarkably strong across different market conditions. Theanalysts tracked $19 billion in ETF flows year-to-date, including $5.5 billionin recent weeks. Each $1 billion of weekly flows correlates with a 3.6 percentreturn increase for Bitcoin, establishing a direct mathematical relationshipbetween institutional demand and price appreciation.

BitcoinETFs have fundamentally altered the cryptocurrency's supply dynamics. Withnearly 6.8 percent of Bitcoin's total supply now held in ETF structures, theseproducts create sustained buying pressure that traditional retail speculationcannot match.

“Fresh back from visits to the USA, it is clear there hasbeen a significant swing to Institutional usage of digital assets. We saw thisat the start of the year with the advent of corporate US BTC treasuries, thenwith the uptake of ETF activity in BTC and ETH," Pual Howard from Wincent commented for FinanceMagnates.com

Bitcoin Price Predictionvs Technical Analysis

Andalthough Citi’s forecast is extremely bullish, from the perspective of thetechnical analysis I conducted, the situation on Bitcoin’s chart hasn’t changedmuch since the first half of last month. We remain in the same consolidationrange, between the $116,000 support level andresistance around $120,000, which was established on July 14 when Bitcoinset its most recent all-time high just above $122,000. Since then, the $120,000level has served as a key resistance that the market has attempted to breakthrough multiple times, but so far without success.

The longerwe stay below this level, the higher the likelihood that Bitcoin Bitcoin While some may still be wondering what is Bitcoin, who created Bitcoin, or how does Bitcoin work, one thing is certain: Bitcoin has changed the world.No one can remain indifferent to this revolutionary, decentralized, digital asset nor to its blockchain technology.In fact, we’ve gone a long way ever since a Florida resident Laszlo Hanyecz made BTC’s first official commercial transaction with a real company by trading 10,000 Bitcoins for 2 pizzas at his local Papa John’s.One could now argue that While some may still be wondering what is Bitcoin, who created Bitcoin, or how does Bitcoin work, one thing is certain: Bitcoin has changed the world.No one can remain indifferent to this revolutionary, decentralized, digital asset nor to its blockchain technology.In fact, we’ve gone a long way ever since a Florida resident Laszlo Hanyecz made BTC’s first official commercial transaction with a real company by trading 10,000 Bitcoins for 2 pizzas at his local Papa John’s.One could now argue that Read this Term will enter acorrection, as buying momentum weakens and sell orders, whether fromprofit-taking or bearish positioning, increase. In that case, I would expect ashort-term pullback to around $112,000, where the late-May high and the 50-dayexponential moving average (EMA) currently align. A break below that levelcould open the path to the next support near $108,000, which corresponds to thehighs from the turn of the year. The final line of defense for the bulls wouldbe the psychological level of $100,000, last tested in mid-June and now alignedwith the 200 EMA.

Any movedown to that level, in my view, would still qualify as a technical correction, anda potential buying opportunity at more attractive prices. However, a breakbelow the 200 EMA and $100,000 would suggest that bears have regained control.In that scenario, I would start considering short positions, targeting a movedown to the April lows near $76,000.

You mayalso like: WillBitcoin Reach $200K? 10x Research Shares BTC Price Prediction for 2025

Bitcoin Technical Levels –Summary Table

|

Level (USD) |

Type |

Description / Significance |

|

122,000 |

All-Time High (ATH) |

Most recent ATH, set on July 14 |

|

120,000 |

Key Resistance |

Frequently tested; marks top of current consolidation |

|

116,000 |

Support |

Bottom of current consolidation range |

|

112,000 |

Short-Term Support |

Late-May high; near 50-day EMA |

|

108,000 |

Secondary Support |

High from the turn of the year |

|

100,000 |

Major/Psychological Support |

Aligned with 200-day EMA; last tested mid-June |

|

76,000 |

Bearish Target |

April low; potential downside target if $100k is broken |

Why Bitcoin Price IsSurging? The Network Effect

Citi'supdated valuation framework simplifies Bitcoin price prediction to itsessential element: adoption rates. The bank's analysis suggests Bitcoin's valuedirectly correlates with how many people want to own Bitcoin rather thancomplex technical indicators or speculative metrics.

Thisapproach discards previously popular models like stock-to-flow ratios andmining cost calculations. Instead, Citi focuses on active wallet addresses andnetwork participation as primary valuation drivers.

Theadoption model reveals Bitcoin's current price trades above historical networkmetrics, suggesting mean reversion could provide additional upside over thecoming months. With a 36-week average reversion period, current elevated levelsmay normalize higher rather than correct downward.

Related: TomLee Called Bitcoin's Peak In 2024 And Just Made Another Bold 2,400% BTC PricePrediction

Corporate Treasury DemandAmplifies Price Pressure

Beyond ETFflows, corporate Bitcoin adoption creates additional supply constraints thatsupport higher prices. Treasury companies and corporations now warehouseapproximately 4 percent of Bitcoin's fully diluted supply, representingbillions in institutional capital.

Thiscorporate demand operates independently from ETF flows, creating multiplelayers of sustained buying pressure. Unlike retail speculation that ebbs andflows with market sentiment, corporate treasury allocation represents long-termstrategic positioning that rarely reverses quickly.

Thecombination of ETF demand and corporate treasury accumulation removessubstantial Bitcoin supply from active trading, creating scarcity dynamics thatsupport continued price appreciation.

Macro Factors SupportBitcoin Price Growth

Citi'sanalysis acknowledges Bitcoin's increasing correlation with traditionalfinancial markets while maintaining its unique value proposition. Thecryptocurrency now benefits from broad equity market strength and dollarweakness while retaining its digital scarcity characteristics.

Bitcoin'sintegration into major financial indices means crypto-agnostic investors mustdevelop Bitcoin price views to manage portfolio exposure effectively. Thisforced institutional engagement creates sustained analytical coverage andlegitimacy that supports long-term adoption.

Thepolitical environment adds another supportive factor, with regulatory clarityenabling traditional financial institutions to increase crypto ecosysteminvolvement. This institutional onboarding creates self-reinforcing cycles ofadoption and price appreciation.

Risk Factors Could ImpactBitcoin Price Trajectory

Despitebullish fundamentals, Citi acknowledges significant risks that could derailBitcoin price predictions. Low velocity metrics suggest most Bitcoin remainsdormant rather than actively traded, creating potential volatility if sellingpressure emerges.

Theanalysts note that Bitcoin velocity currently matches levels from 2010 when10,000 bitcoins bought two pizzas, indicating extreme illiquidity in spotmarkets. While this supports current price levels, it could amplify downsidemoves if ETF flows reverse.

MichaelSaylor's MicroStrategy and similar corporate buyers continue absorbingavailable Bitcoin supply, but this concentration createssingle-point-of-failure risks if major holders adjust their strategies.

Why Bitcoin PricePredictions Matter Now

Bitcoinprice analysis has evolved beyond speculative trading as the cryptocurrencyachieves mainstream financial integration. Citi's institutional frameworkprovides sophisticated investors with tools to evaluate Bitcoin exposurewithout relying on heuristics or average price assumptions.

The bank's$135,000 base case reflects measured optimism based on continued ETF adoptionand institutional integration. However, the $199,340 bull case demonstratesBitcoin's potential if current adoption trends accelerate through year-end.

As Bitcoinprice discovery increasingly depends on institutional flows rather than retailsentiment, professional analysis like Citi's framework becomes essential forunderstanding market dynamics. The cryptocurrency's evolution from speculativeasset to institutional allocation fundamentally changes how Bitcoin pricepredictions should be evaluated.

Bitcoin'sjourney toward Citi's price targets depends primarily on continuedinstitutional adoption and ETF flows. With regulatory clarity improving andcorporate treasury demand remaining strong, the fundamental drivers supportinghigher Bitcoin prices appear increasingly sustainable.

Bitcoin News FAQ

How High Can BitcoinRealistically Go?

Bitcoin'srealistic price potential depends on institutional adoption rates and networkeffects rather than pure speculation. Citigroup's comprehensive analysissuggests Bitcoin could reach $135,000 to $199,000 within the current marketcycle based on sustained ETF flows and corporate treasury adoption.

Will Bitcoin Go to 1Million?

Themillion-dollar Bitcoin thesis requires exponential adoption growth that exceedscurrent institutional integration patterns. Cathie Wood's $1 million five-yearforecast represents the most prominent advocate for this target, though hertimeline extends well beyond current analytical frameworks.

How Much Will 1 Bitcoin BeWorth in 2030?

Bitcoin's2030 valuation depends on institutional adoption reaching maturity andregulatory frameworks stabilizing across major economies. Conservativeprojections from traditional financial institutions suggest Bitcoin could tradebetween $300,000 to $500,000 by 2030 if current adoption trends continue.

How High Could Bitcoin Goin 2025?

Bitcoin's2025 potential builds directly on current institutional momentum and regulatoryclarity trends. Citigroup's year-end targets of $135,000 to $199,000 provideprofessional baseline expectations based on measurable adoption metrics ratherthan speculative projections.

Content Original Link:

" target="_blank">