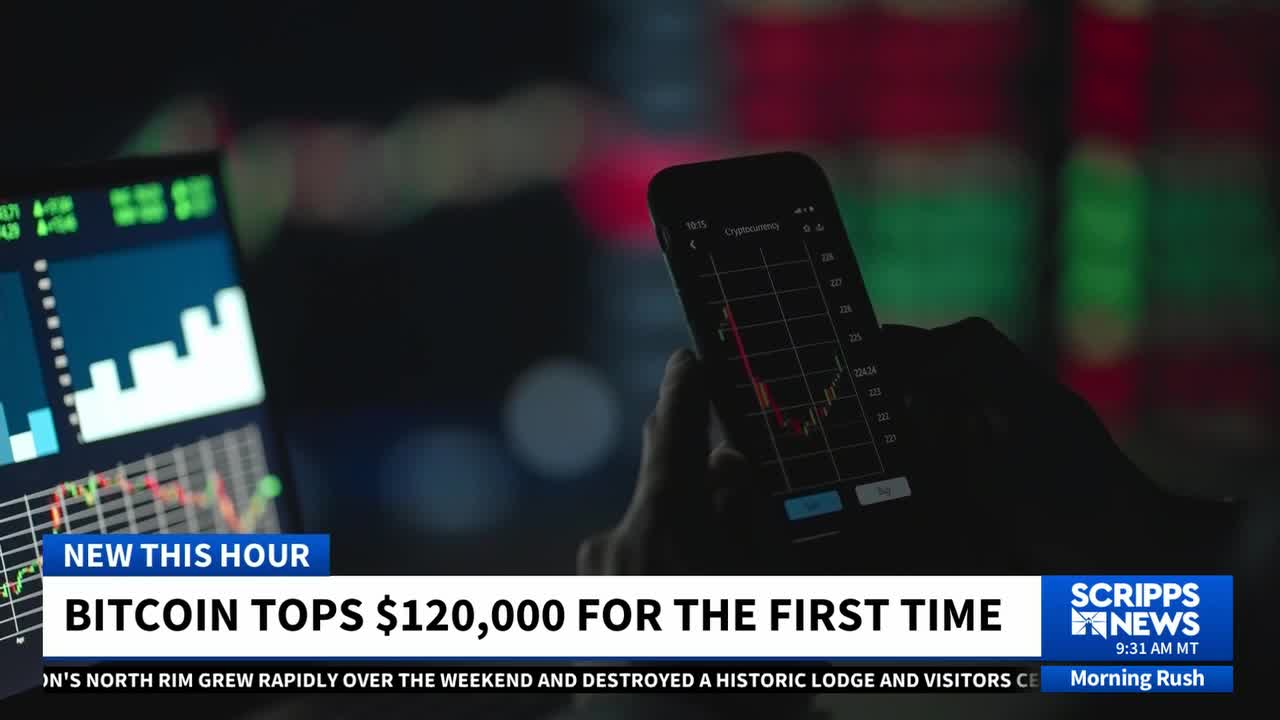

Bitcoin and crypto are on an upswing. How long can it continue?

July was good to Bitcoin, and some analysts think this may just be the warmup.

Although Bitcoin was last down 0.35% at $115,396.40, below its record peak of around $123,000, some analysts aren't worried.

Tom Lee, managing partner and head of research at Fundstrat Global Advisors who predicted Bitcoin's peak in 2024, has said he thinks Bitcoin willl reach $250,000 before the end of the year.

Bitcoin climbed to a record high on July 14 as weekly cryptocurrency investment products saw record weekly inflows, pushing the total crypto market to top $4 trillion for the first time ever.

With new legislation signed into law last month and skyrocketing institutional buying, there's little doubt digital assets are becoming more mainstream, they say. Earlier in the year, crypto exchange Coinbase also became the first crypto exchange to join the S&P 500, marking a major milestone for the digital asset industry.

"Bitcoin pulling back after reaching a new all-time high is not unusual," said Samer Hasn, Senior Market Analyst at global broker XS.com. Often, rallies are followed by dips, so people can take some profits around key technical levels. The drops also allow people who are sidelined and don't want to buy at the highs a lower entry point.

Regulations give institutions green light

The GENIUS Act, signed into law on July 18, creates a regulatory framework for stablecoins, a popular type of cryptocurrency tied to the value of stable assets like the U.S. dollar.

The Act "marks a turning point in federal crypto oversight," said Frank Walbaum Market Analyst at socal investing platform Naga. "Regulatory clarity could support institutional adoption and long-term market maturation."

Crypto has already seen a flood of new interest, with money flooding into crypto exchange traded funds, or ETFs that trade like stocks on an exchange but have holdings that track an index or other underlying asset. iShares Bitcoin Trust ETF, which seeks to reflect generally the performance of the price of bitcoin, became the fastest growing ETF ever in terms of assets.

"The crypto ETF pie is growing fast because of broader adoptions after executive orders by President Donald Trump that are in the process of breaking down regulatory barriers that previously stood in the way of broader crypto adoption," said Bryan Armour, Morningstar’s director of ETF and passive strategies.

Who's buying crypto?

Buyers are mostly young American males, according to a Deutsche Bank survey of U.S., UK and EU residents in June.

In the United States, 23% of men versus 13% of women use cryptocurrency as a form of payment or personally invest in crypto, the survey showed. That's up from 20% and 12%, respectively, in January.

Individual investors also tend to be young in the U.S. Among 18–34-year-olds, the share of investors increased to 29% in June from 24% in January, due to "excitement over Trump’s pro-crypto administration," said Marion Laboure, senior economist at Deutsche Bank. Adoption rates have been on an upwards trend since Trump’s election in November.

U.S. investors also tend to have more money. U.S. crypto adopters tend to have income above $100,000 annually (34%). It was a 32% adoption rate for those earning between $50,000 and $100,000.

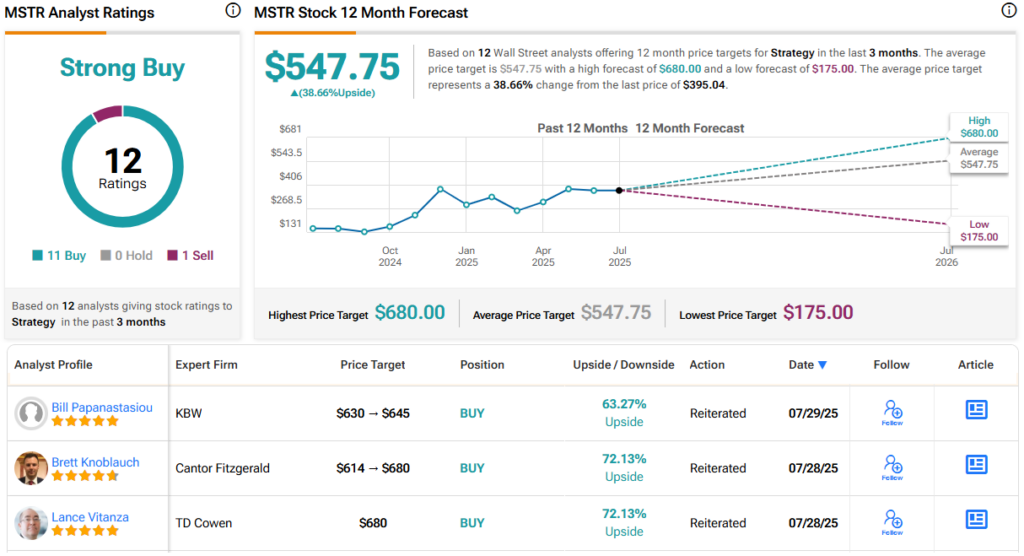

More companies also are building Bitcoin treasuries.

For example, MicroStrategy, which began buying Bitcoin in 2020, has since sold equity, issued various types of debt and layered stacks of preferred shares on top to raise money to buy more. In its latest earnings regulatory filing, it said it would do so again, selling $4.2 billion more in preferred stock to buy more of the digital coin. Its Bitcoin holdings helped the company's results top second-quarter estimates with a surprising profit.

Metaplanet also said in a regulatory filing it plans to potentially issue up to $3.7 billion worth of perpetual preferred shares and use proceeds to buy more Bitcoin. It has said it wants to accumulate 210,000 Bitcoin by the end of 2027.

Medora Lee is a money, markets, and personal finance reporter at USA TODAY. You can reach her at

Content Original Link:

" target="_blank">