Continental Resources Files a $69 Million Lawsuit Against Hess Midstream

Continental Resources, a petroleum and natural gas exploration and production company headquartered in Oklahoma City, filed a lawsuit against Hess Corp (NYSE:HES) in federal court. The latter is accused of manipulating internal agreements and inflating midstream fees, extracting up to $69 million at the expense of its partners. The lawsuit directly implicates Hess Midstream LP (NYSE:HESM).

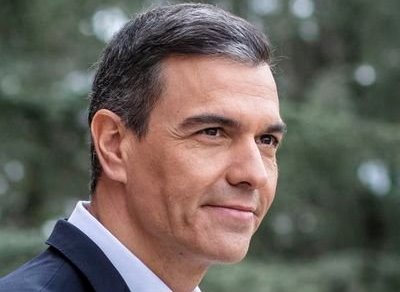

A worker measuring crude oil inside a rail tank car.

Hess Midstream LP (NYSE:HESM) owns, operates, develops, and acquires midstream assets and provides fee-based services to Hess and third-party customers in the United States. Hess Corp (NYSE:HES) holds a 38% stake in Hess Midstream LP (NYSE:HESM).

Hess structured contracts with its wholly owned subsidiaries, including Hess Midstream Partners, in a way that diverted value from upstream assets to midstream operations.

Continental is a non-operating working interest owner in close to 483 wells operated by Hess Bakken Investments in North Dakota's Williston Basin. The company alleges it has been financially disadvantaged owing to the increased service fee that does not match the market rates.

As per the complaint, these excessive midstream charges have significantly reduced Continental’s net hydrocarbon revenues. The firm estimates losses ranging between $34 million and $69 million because of these transactions.

Hess Corp is yet to respond publicly to the allegations, while Continental declined to comment on ongoing litigation.

While we acknowledge the potential of HESM as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns and have limited downside risk. If you are looking for an AI stock that is more promising than HESM and that has 100x upside potential, check out our report about the cheapest AI stock.

READ NEXT: 10 Unstoppable Dividend Stocks to Buy Now

Disclosure: None.

Content Original Link:

" target="_blank">