Here is Why SolarEdge (SEDG) Crashed by Almost 25% Today

The share price of SolarEdge Technologies, Inc. (NASDAQ:SEDG) fell by 24.67% on May 22, 2025. Let's shed some light on the development.

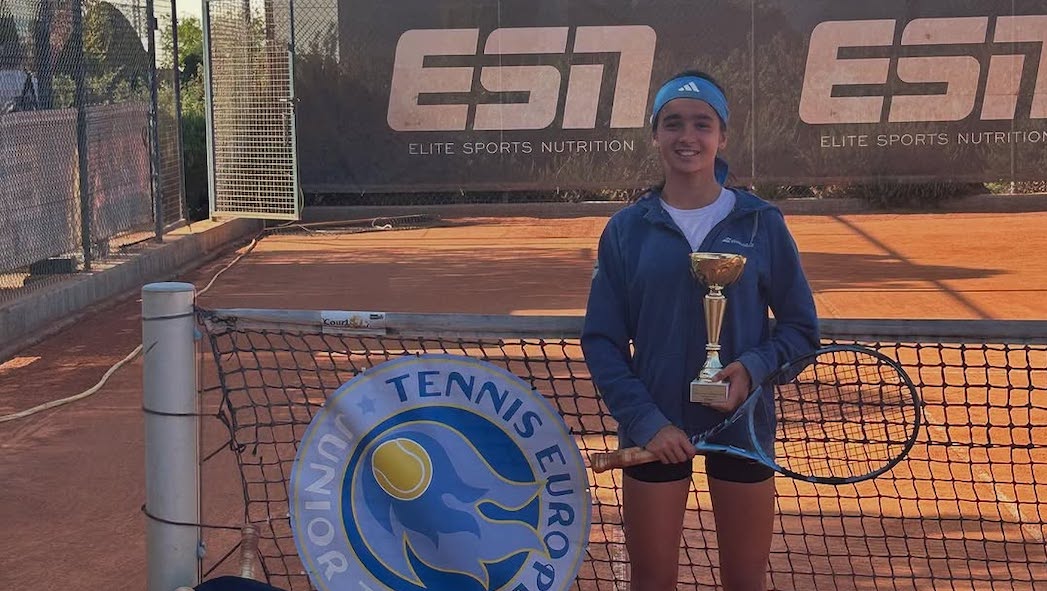

A technician installing a communication device in a large solar energy system.

SolarEdge Technologies, Inc. (NASDAQ:SEDG) designs, develops, manufactures, and sells direct current optimized inverter systems for solar photovoltaic installations in the United States, Germany, the Netherlands, Italy, rest of Europe, and internationally.

SolarEdge Technologies, Inc. (NASDAQ:SEDG) suffered a major blow after the House of Representatives narrowly passed President Trump's 'one big beautiful bill' that terminates key clean energy credits that have supported the country's renewable energy industry. The legislation, now moving to the Senate, takes a 'sledgehammer' to the Biden era's Inflation Reduction Act, repealing grants intended to reduce air pollution, greenhouse gas emissions or purchase electric heavy-duty vehicles.

The solar energy industry, which relies heavily on the said credits, has been hit particularly hard. The sweeping tax and spending bill makes it impossible for solar energy players to claim or transfer tax tax credits, while terminating them completely for installers that lease equipment to customers. Moreover, a tax credit for homeowners that own their own panels will also be eliminated. As a result, SolarEdge Technologies, Inc. (NASDAQ:SEDG) plummeted due to shaking investor confidence, as sales of its inverters would take a hit from lower demand for rooftop solar.

It must be mentioned that SolarEdge Technologies, Inc. (NASDAQ:SEDG) recently posted an adjusted loss per share of $1.14 for its first quarter of 2025, still beating forecasts by $0.02. The company's revenue also grew by 7.4% YoY to almost $219.5 million, topping expectations by $15.25 million.

While we acknowledge the potential of SEDG to grow, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns, and doing so within a shorter time frame. There is an AI stock that went up since the beginning of 2025, while popular AI stocks lost around 25%. If you are looking for an AI stock that is more promising than SEDG but that trades at less than 5 times its earnings, check out our report about this cheapest AI stock.

READ NEXT: 10 Cheap Energy Stocks to Buy Now and 10 Most Undervalued Energy Stocks to Buy According to Hedge Funds

Disclosure: None.

Content Original Link:

" target="_blank">