Jefferies Raises First Solar (FSLR) Price Target to $157

It was recently reported that analysts at Jefferies have updated the price target for First Solar, Inc. (NASDAQ:FSLR) to $157. Let's shed some light on the development.

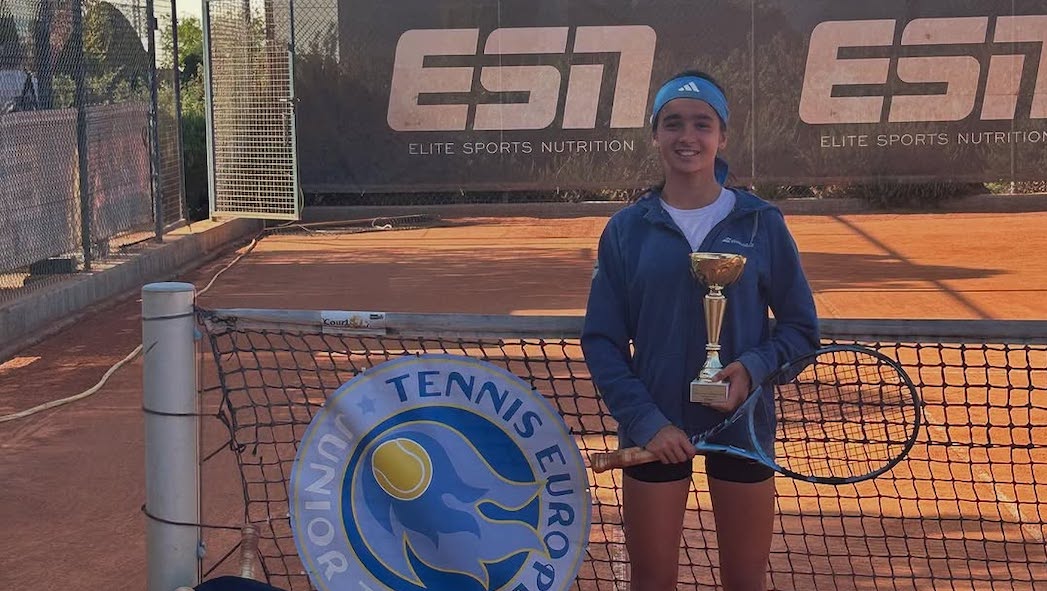

A solar panel farm with an orange sky illuminating the vast landscape.

First Solar, Inc. (NASDAQ:FSLR) is a leading American solar technology company and global provider of responsibly produced eco-efficient solar modules. FSLR is unique among the ten largest solar manufacturers in the world for being the only US-based company and not manufacturing in China.

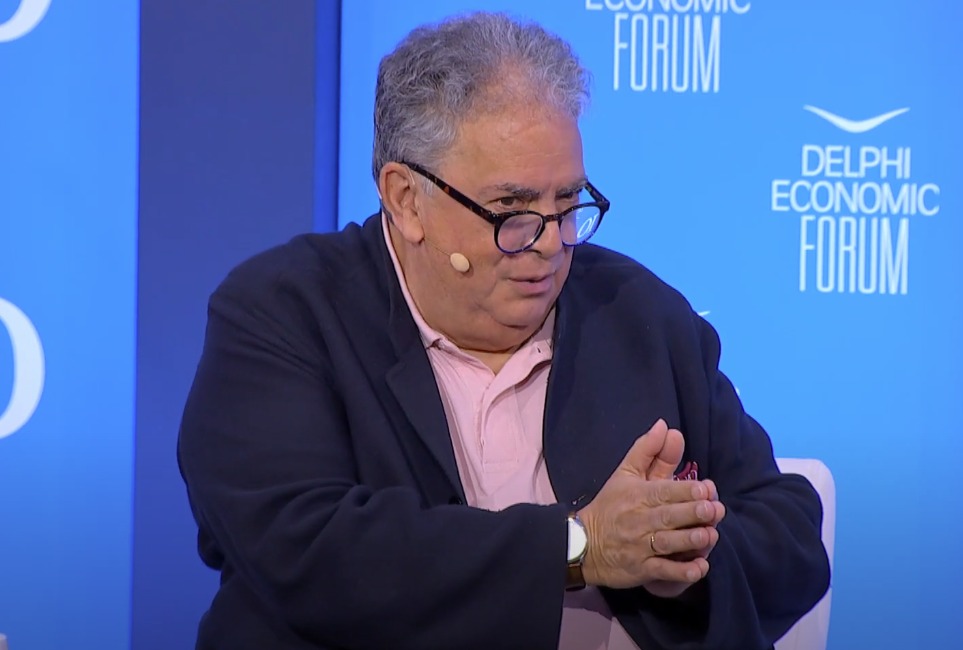

On May 22, 2025, Jefferies analyst Julian Dumoulin-Smith updated the price target for First Solar, Inc. (NASDAQ:FSLR) from $127 to $157, while maintaining a Hold rating on the stock. The revised outlook comes as a result of of the potential impacts of the House bill, which includes restrictions under the Foreign Energy Output Credit (FEOC). Moreover, the analyst mentions that with the Anti-Dumping/Countervailing Duties (AD/CVD) endorsed by the ITC, there could be an increased demand for First Solar’s modules as developers might seek to safe harbor ahead of policy changes.

It must be mentioned that First Solar, Inc. (NASDAQ:FSLR) had a tough start to the year 2025, as its Q1 EPS of $1.95 missed expectations by a hefty $0.6. The company’s revenue of $844.57 million, though in-line with market estimates, was also down sharply from $1.5 billion in Q4 2024, primarily due to ‘an anticipated seasonal reduction in the volume of modules sold.’ That said, First Solar boasts one of the strongest balance sheets in the solar industry, with $0.4 billion in net cash at the end of the first quarter.

While we acknowledge the potential of FSLR to grow, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns, and doing so within a shorter time frame. There is an AI stock that went up since the beginning of 2025, while popular AI stocks lost around 25%. If you are looking for an AI stock that is more promising than FSLR but that trades at less than 5 times its earnings, check out our report about this cheapest AI stock.

READ NEXT: 10 Cheap Energy Stocks to Buy Now and 10 Most Undervalued Energy Stocks to Buy According to Hedge Funds

Disclosure: None.

Content Original Link:

" target="_blank">