Fed to Take in Stride Another Month of Tame Inflation

The holiday-shortened week for economic data also includes the government’s second reading of first-quarter gross domestic product, April durable goods orders, and a pair of consumer confidence surveys.

-

For more, read Bloomberg Economics’ full Week Ahead for the US

In Canada, the economy appears likely to miss the Bank of Canada’s forecast of 1.8% annualized growth in the first quarter, with industry-based figures so far pointing to a 1.5% expansion in data on Friday. Canada’s head of state, King Charles III, will lay out Prime Minister Mark Carney’s priorities in a speech on Tuesday marking the opening of Parliament that will shed more light on spending plans.

Elsewhere, industrial profits in China, inflation across the euro zone, and rate cuts in South Korea and New Zealand may be among the highlights.

Click here for what happened in the past week, and below is our wrap of what’s coming up in the global economy.

Asia

The wave of economic readings from Asia continues, with key growth indicators from India and Taiwan as well as central bank decisions in South Korea and New Zealand.

Observers will get a better sense of how Trump’s trade war is hitting commerce, starting with Hong Kong’s April trade data due on Monday. On Wednesday, Sri Lanka publishes trade figures for April. Thailand and the Philippines release data on April exports and imports Friday.

Production across the region, the world’s factory floor, will also be in focus. China on Tuesday is set to report industrial profits for April, an area under increased pressure as deflation and the trade war weigh. India releases industrial production figures on Wednesday, which are forecast to have slowed. And South Korea and Japan report April industrial production on Friday that are also expected to slow — and in Japan’s case contract — as demand wanes.

South Korea’s central bank is seen cutting rates on Thursday by a quarter point, to 2.5%, to support growth. They’ll follow New Zealand’s monetary authorities, which are expected to lower the key policy rate by a quarter point to 3.25% on Wednesday. South Korea also releases April retail sales and May consumer confidence in the coming week.

Japan reports a ream of data on the rest of the economy. That includes April producer prices on Monday, followed by May consumer prices for Tokyo on Friday. The jobless rate was likely unchanged in April, and retail sales on Friday are set to show that activity remained largely steady.

Other major releases include India’s first-quarter GDP reading on Friday, which is forecast to have strengthened. Australia will get April readings on consumer price inflation, which has been running hot lately, and retail sales, which are likely to remain steady.

Elsewhere, Macau on Thursday reports its hotel occupancy rate for last month, an insight into Chinese tourism in Asia’s casino capital.

-

For more, read Bloomberg Economics’ full Week Ahead for Asia

Europe, Middle East, Africa

The working week will be shorter in several countries. As with the US, the UK has Monday off, while Thursday is a holiday across northern continental Europe.

With the European Central Bank lining up for a further rate cut in June, Thursday marks the start of a pre-decision blackout period for officials. Policymakers scheduled to speak before then include President Christine Lagarde on Monday, as well as governors of the French and German central banks.

Several reports in the euro region are likely to interest investors, with inflation numbers scheduled in all four of its top economies, starting with France on Tuesday. Price growth there is seen staying at 0.9%.

The other three are scheduled for Friday, with results at 1.9% anticipated in Italy and 2% in both Spain and Germany. Together, those economies account for more than 70% of the overall euro area.

If the surveys are accurate, May will mark the first time in eight months, and only the second time since 2021, that annual consumer-price growth hasn’t exceeded the ECB’s 2% goal in any of those countries.

In a quieter week for UK data, speeches by Bank of England chief economist Huw Pill on Wednesday, and Deputy Governor Sarah Breeden and Governor Andrew Bailey on Thursday, may draw the most attention.

In Switzerland, export numbers for April, when the country initially faced 31% tariffs from the US, will be released on Tuesday. Sweden’s economic tendency survey comes the same day, while the Riksbank will release its financial stability report on Wednesday. Swedish GDP numbers are due on Friday.

Also on Friday, data will likely show Turkey’s economic growth remained muted in the first quarter as the central bank sticks to high interest rates to slow inflation.

-

For more, read Bloomberg Economics’ full Week Ahead for EMEA

Some monetary decisions are on the calendar:

-

Israel is set to keep its rate at 4.5% for an 11th straight meeting on Monday, even as the ongoing war hits economic growth.

-

At Hungary’s central bank meeting on Tuesday the rate may be held at 6.5%, tied with Romania for the highest in the EU, due to global risks and the need to anchor price expectations.

-

Mozambique, where rates adjusted for inflation are in positive territory, may reduce its benchmark on Wednesday for a ninth straight time — likely by 50 basis points, to 11.25%. Inflation slowed to 4% in April from 4.8% a month earlier.

-

A day later, officials in South Africa are expected to resume rate cutting, lowering their benchmark by 25 basis points to 7.25%. Higher gold prices and lower oil prices should continue to benefit the currency, and hence the disinflation profile.

-

On Friday, Eswatini — whose currency is pegged to South Africa’s rand — may reduce its key rate as well.

Latin America

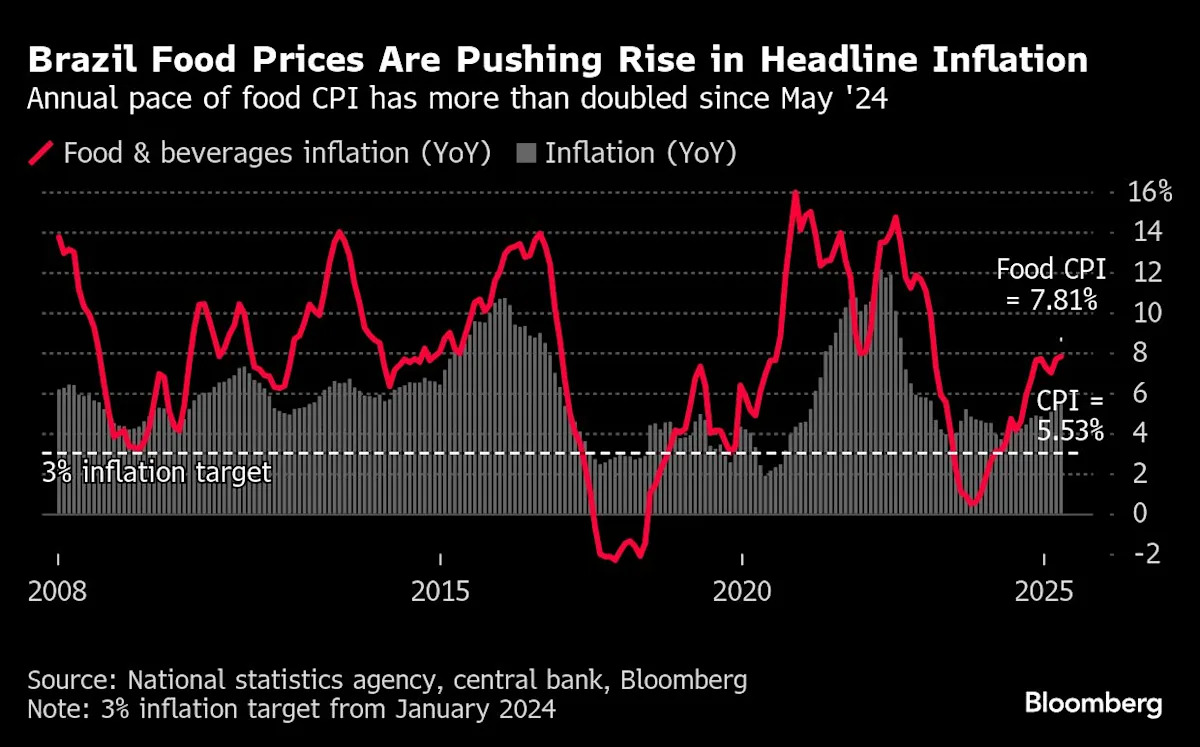

Brazil’s mid-month consumer price report posted Tuesday is the second-to-last inflation reading before the central bank’s June meeting. The April CPI figures point to pressure on headline prints from rising food costs.

In Mexico, the central bank’s quarterly inflation report is keenly awaited: More than a few analysts expect Banxico to mark down its 2025 GDP forecast from the current 0.6%, to perhaps nearer the -0.2% lower range of its previous report.

Banxico will also publish the minutes of its May 15 meeting. While mid-May consumer prices reported on Thursday surprised to the upside, the post-decision statement’s dovish tilt suggests the board may look through the uptick.

Brazil, Chile, Colombia and Mexico will report April labor market figures.

Joblessness is drifting higher in Chile and Brazil — though below what many Brazil watchers see as the economy’s non-accelerating inflation rate of unemployment — while ticking lower in Colombia. Mexico’s March unemployment rate of 2.22% was a record low.

Closing out the week, Brazil on Friday posts first-quarter output data. Latin America’s No. 1 economy is widely forecast to slow in 2025 after three years of growing at 3% or better, though it may be hard to see in the week’s data.

The Getulio Vargas Foundation’s GDP Monitor estimated Brazil’s January-March quarter-on-quarter expansion was 1.6%, the fastest since 2020.

-

For more, read Bloomberg Economics’ full Week Ahead for Latin America

--With assistance from Mark Evans, Robert Jameson, Laura Dhillon Kane, Katia Dmitrieva, Monique Vanek, Piotr Skolimowski and Carla Canivete.

Most Read from Bloomberg Businessweek

-

AI Is Helping Executives Tackle the Dreaded Post-Vacation Inbox

-

Microsoft’s CEO on How AI Will Remake Every Company, Including His

©2025 Bloomberg L.P.

Content Original Link:

" target="_blank">

![Ευρωπαίοι καταναλωτές: «Εμπάργκο» στα αμερικανικά προϊόντα [γράφημα]](https://www.ingr.gr/images/joomgrabber/2025-05/43ea5871c1.png)