Jim Cramer on Albertsons Companies (ACI): “This is a Survivor”

We recently published a list of Jim Cramer Had These 21 Stocks on His Radar. In this article, we are going to take a look at where Albertsons Companies (NYSE:ACI) stands against other stocks that Jim Cramer discusses.

A caller inquired about Cramer’s thoughts on Albertsons Companies, Inc. (NYSE:ACI). Here’s what Mad Money’s host had to say:

“Once they got away from that merger, I think that people realized the value of the company. It’s still a low multiple stock. I happen to like Kroger more, but I’ve gotta tell you, this is a survivor, and I think that Albertsons’ going to keep going higher.”

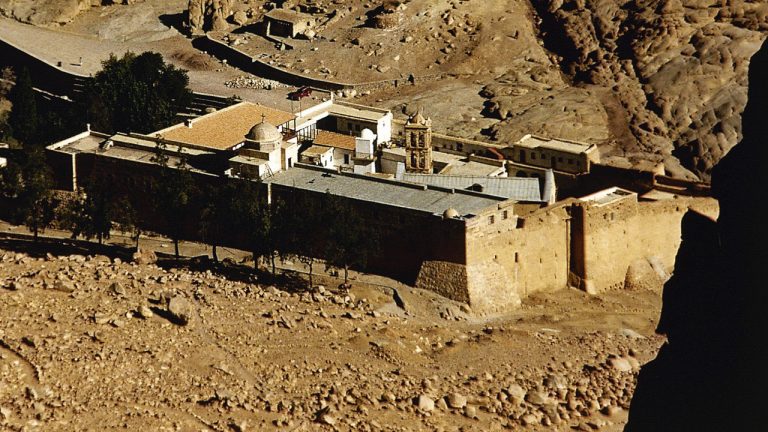

A fresh produce section in a modern grocery store.

Albertsons Companies (NYSE:ACI) runs food and drug stores that sell groceries, health and beauty items, pharmacy products, fuel, and other goods. The company also produces and processes food items for retail under different store names. Longleaf Partners Fund stated the following regarding Albertsons Companies, Inc. (NYSE:ACI) in its Q1 2025 investor letter:

“Albertsons Companies, Inc. (NYSE:ACI) – US grocery retailer Albertsons was a contributor for the quarter. Albertsons was a new purchase in 2024, after we had followed the company and its predecessors for years. In an otherwise turbulent quarter, Albertsons stands out as a stable business that remains undervalued because it had fallen off the radar during a protracted deal process with Kroger that ultimately failed. The company should grow at a moderate pace and has plenty of financial firepower to repurchase shares, all while it has multiple strategic options (such as unlocking its real estate value and/or selling non-core markets) to realize value per share.”

Overall, ACI ranks 12th on our list of stocks that Jim Cramer discusses. While we acknowledge the potential of ACI as an investment, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns and have limited downside risk. If you are looking for an AI stock that is more promising than ACI and that has 100x upside potential, check out our report about this cheapest AI stock.

READ NEXT: 20 Best AI Stocks To Buy Now and 30 Best Stocks to Buy Now According to Billionaires.

Disclosure: None. This article is originally published at Insider Monkey.

Content Original Link:

" target="_blank">