Brazil's Pix set for next leap with launch of recurring payments

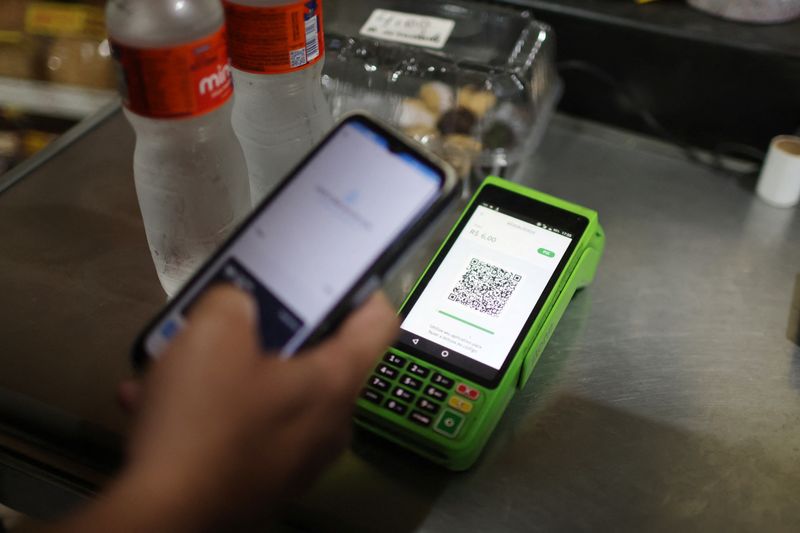

(Reuters) - Brazil's wildly popular instant payment system Pix is poised for another leap with the launch of a new recurring payments feature this month, central bank officials said on Wednesday.

Since its launch in late 2020, Pix has rapidly become the leading payment method in Latin America's largest economy, surpassing cash as well as debit and credit cards. Last year it handled more than 26 trillion reais ($4.61 trillion) in transactions.

Initially slated for launch last October, the new feature will go live on June 16, allowing users to authorize recurring charges with a single consent, according to the central bank, which developed and operates Pix.

That will allow for automatic payments of utilities, phone bills, school tuition, gym memberships, and digital or streaming services via the new "Pix Automatico" tool.

"'Boleto' will be overtaken by Pix Automatico when it comes to automatic payments," said Renato Gomes, the central bank's financial system organization director. Boleto is the traditional slip method, which moved 6.2 trillion reais last year, according to banking federation Febraban.

Speaking at a central bank event in Sao Paulo to present the feature, Gomes added that existing automatic debit services via banks are also likely to be disrupted by the new tool.

Companies must sign bank agreements to offer automatic debit, a process central bank regulation director Gilneu Vivan described as burdensome for small businesses. Pix Automatico will simplify the process, allowing small merchants to receive recurring payments with ease.

Vivan also noted that nearly 60 million Brazilians do not own a credit card, a group that will now be able to access subscription-based services previously limited to cardholders.

A study by payments platform EBANX estimates that Pix Automatico could handle at least $30 billion in e-commerce transactions within its first two years of operation.

($1 = 5.6418 reais)

(Reporting by Marcela Ayres; Editing by Richard Chang)

Content Original Link:

" target="_blank">