Wall Street’s Elite Get Serious About Debt Alarmism

The US has been racking up budget deficits for most of the past half-century, but the leader of the country’s largest bank by assets and the head of the world’s largest asset manager think enough is enough.

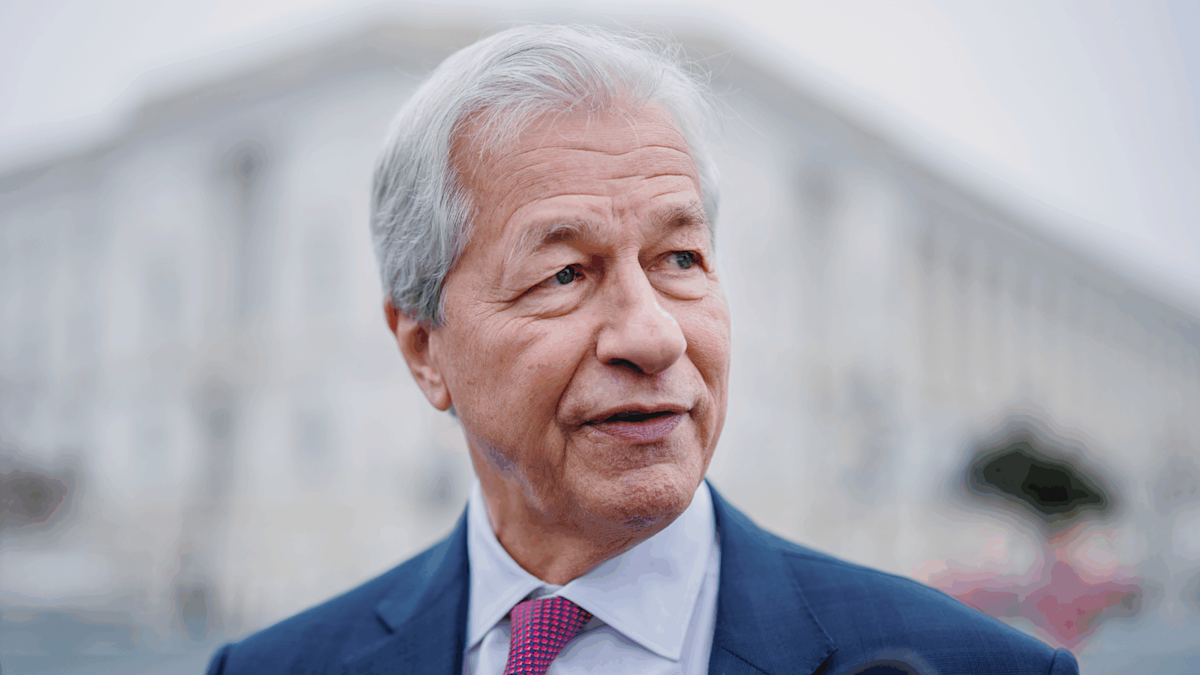

JPMorgan CEO Jamie Dimon and BlackRock CEO Larry Fink were the leading voices in a chorus of billionaires who sounded off last week about higher deficit spending in the US. The resulting mountain of debt could soon rival Denali (the highest US peak), leading to concerns that interest expenses will engulf federal spending, which will drag down growth, which in turn will drag down everything else.

The Game is Bond

The worries start in the bond market, which Dimon warned could “crack” during May 30 remarks to the Reagan National Economic Forum. The long-term yields in America’s $29 trillion Treasurys market have flirted with 5% in recent weeks, with the 30-year yield at 4.963% on Friday. That has made for the highest levels since 2023. The yield on the 10-year Treasury note, meanwhile, has risen to 4.51% from below 3.7% in September. Higher yields mean the government generally has to pay higher interest to bond investors, who are fewer and increasingly less inclined to offer cheap, long-term funding to finance the nation’s debt, hence Dimon’s prediction of a “crack.”

US deficit spending, which is at 120% of GDP, according to the Federal Reserve Bank of St. Louis, is set to balloon under the “big, beautiful” Trump-backed GOP spending bill in Congress. The Committee for a Responsible Federal Budget estimates the bill would add $3.3 trillion to the $36.2 trillion US debt by 2034. That means more interest payments, which are already eating up federal spending: The $892 billion in interest payments on the debt equaled approximately 13% of the total federal budget in 2024, according to the Center on Budget and Policy Priorities, leapfrogging what is spent on Medicare or defense. None of this, Dimon, Fink and others are warning, is ideal:

- “If people decide that the US dollar isn’t the place to be, you could see credit spreads gap out; that would be quite a problem,” Dimon told Fox Business last week, alluding to the greenback’s 9% decline this year, an indication foreign investors have become less interested in US assets. “It hurts the people raising money. That includes small businesses, that includes loans to small businesses, includes high-yield debt, includes leveraged lending, includes real estate loans. That’s why you should worry about volatility in the bond market.”

- Fink, citing the GOP spending plan, warned a Forbes conference in New York last week that if US economic growth continues “to stumble along at a 2%” rate, deficits will overwhelm the country and “we’re going to hit the wall.” Citadel founder Ken Griffin, speaking at the same conference, offered his own two cents: running a deficit of 6 or 7 percent of GDP with full employment was “just fiscally irresponsible” (Moody’s cautioned that the bill will push the deficit from 6.4% of GDP in 2024 to nearly 9% by 2035).

Problem Solver: Treasury Secretary Scott Bessent dismissed Dimon’s concern about the bond market. “He’s made predictions like this” before, Bessent said. “Fortunately, none of them have come true.” Dimon, who told the Reagan Forum he doesn’t know “if it’s going to be a crisis in six months or six years,” was insistent but offered a way to ward off his prediction: “Change the trajectory of the debt” and relax rules on banks’ engaging in bond trading, allowing them to provide more financing if markets freeze up.

Content Original Link:

" target="_blank">