Photronics, Inc. (PLAB): A Bull Case Theory

We came across a bullish thesis on Photronics, Inc. on Enterprising Investor’s Substack by Tyler Moody. In this article, we will summarize the bulls’ thesis on PLAB. Photronics, Inc.'s share was trading at $20.36 as of July 31st. PLAB’s trailing P/E was 10.54 according to Yahoo Finance.

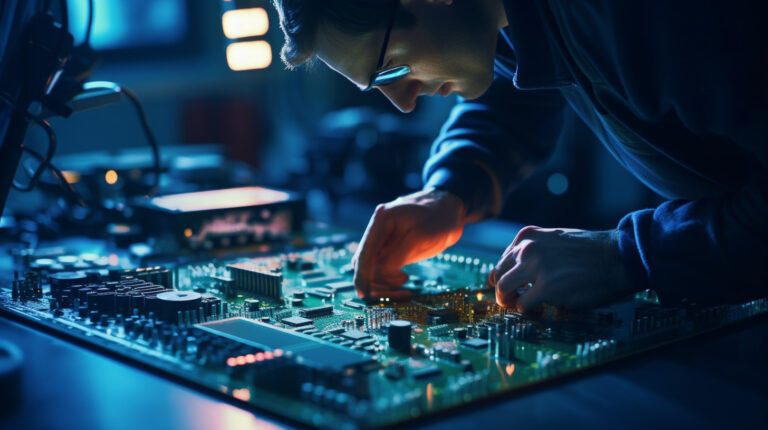

An engineer manipulating a complex circuit board that will be used in flat panel displays.

Photronics (PLAB), a manufacturer of photolithography masks essential for semiconductor production, was initially flagged for its low free cash flow multiple. A deeper valuation analysis supports the bullish view. Historically, PLAB’s PE ratio has fluctuated between 7.5 and 15, highlighting volatility but also opportunity. While recent returns on assets have exceeded the company’s estimated cost of capital, long-term performance has been less consistent, partially due to a large cash balance and significant reinvestment cycles.

Given this inconsistency, an earnings power valuation approach—excluding growth assumptions—was applied. Revenue remained flat through the 2010s but began ramping significantly post-2019, peaking in 2022 amid heightened demand for high-end photomasks. 2024 sales moderated to $867M, with a TTM figure of $857M, which appears to be a mild cyclical dip rather than a trend reversal. Using a stabilized revenue estimate of $850M, a five-year average gross margin of 31.4%, and current operating expenses of $95M, estimated operating income comes in at $171.9M, or a 20.2% margin. After-tax earnings (NOPAT) are projected at $128.9M.

Using an 8% discount rate, reflecting PLAB’s small-cap nature but strong balance sheet, the enterprise value is calculated at $1.6B. With $558M in cash and $396M in minority interest, the resulting equity value is $1.77B, translating to a fair value of $29 per share. Shares were recently purchased at $18.50 and have since risen ~10%, but the fundamental case implies further upside remains. PLAB’s resilient financial profile, cyclical positioning, and undervaluation create a compelling opportunity for long-term investors.

Previously, we covered a bullish thesis on Photronics, Inc. (PLAB) by Virtual_Seaweed7130 in April 2025, which highlighted the company’s strong operating margins, undervaluation relative to peers, and strategic U.S. manufacturing position. The company’s stock price has appreciated by approximately 15.22% since our coverage. This is because the thesis partially played out. Tyler Moody shares a similar view but emphasizes a more conservative valuation approach.

Photronics, Inc. is not on our list of the 30 Most Popular Stocks Among Hedge Funds. As per our database, 25 hedge fund portfolios held PLAB at the end of the first quarter which was 23 in the previous quarter. While we acknowledge the potential of PLAB as an investment, we believe certain AI stocks offer greater upside potential and carry less downside risk. If you're looking for an extremely undervalued AI stock that also stands to benefit significantly from Trump-era tariffs and the onshoring trend, see our free report on the best short-term AI stock.

Content Original Link:

" target="_blank">