Bitcoin Rules for Now, but the Crypto Landscape Is Vast

Investors want more than just a bit of bitcoin.

Spot Bitcoin ETFs amassed inflows of nearly $9.6 billion from April 21 through May 27, according to data compiled by Morningstar Direct. With the price of the world’s most popular cryptocurrency reaching all-time highs of more than $100,000 lately and the Trump administration championing digital assets, advisors might now want to expand their focus beyond just bitcoin.

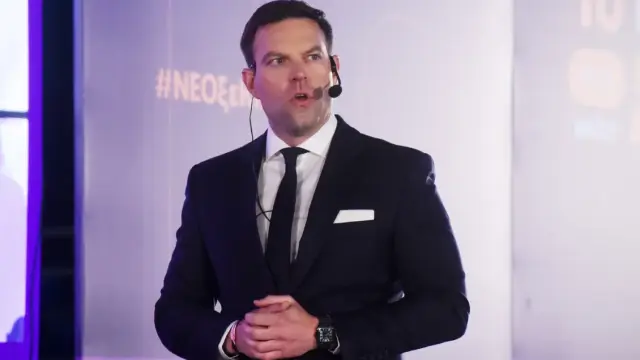

“The capitalization of the crypto space right now is more than $3 trillion. How can you ignore that?” said Campbell Harver, Duke University professor and partner at Research Affiliates. “It’d be like ignoring a couple of companies in the Magnificent Seven.”

Bitcoin Blinders

While spot Bitcoin ETFs have been seeing plenty of momentum lately, iShares Bitcoin Trust ETF (IBIT) is the real winner. Over roughly the past five weeks, IBIT has taken in $8.7 billion, per Morningstar. That’s about 80% of its total inflows year-to-date. Bitcoin and ETFs that track it may be a new corner of portfolios, but advisors are quickly growing more comfortable with it. “Most of my clients have a 5-10% allocation to Bitcoin,” said Mike Casey, founder of AE Advisors. “Some are allocated significantly higher.”

Bitcoin and IBIT are clearly the biggest players in the space, but advisors should have a wider view when considering crypto allocations, Harvey said, recommending wealth managers consider stablecoins — digital currencies pegged to traditional assets like the US dollar or gold. “In my vision of the future, almost all assets will be tokenized — stocks, debts, mortgages, all this stuff,” he told Advisor Upside. “We’re going in that direction, and stablecoins are the first step.”

But of course, stay away from meme coins. “They have no fundamental value whatsoever,” Harvey said. “They’re like trading cards.”

Golden Hour. Amidst the current economic uncertainty,some have begun viewing Bitcoin as a safe haven similar to gold, but that’s still debated territory, given that their volatility profiles are drastically different, said Joy Yang, head of product management at MarketVector Indexes. “Gold is more of a slow and steady type of asset and has been quietly outperforming US equities over the past 20 years,” she told Advisor Upside. “Bitcoin has done it, too, but in a much more rollercoaster type of movement.”

In the same five-week span, Gold ETFs have experienced almost $2.8 billion in outflows, with State Street’s SPDR Gold Shares (GLD) accounting for nearly all of that, according to Morningstar. The precious metal’s price per ounce is down from an all-time high of $3,500 in late April. However, gold is still outperforming Bitcoin, up 28% YTD compared with Bitcoin’s 12% as of Monday.

“Bitcoin is still a teenager,” Yang said. “It’ll eventually be an adult, but it’s going to take a winding path to get there.”

Content Original Link:

" target="_blank">