Bitcoin Sell-Off Warning? Miner-To-Exchange Transfers Hit Historic Highs

Bitcoin (BTC) experienced a mild sell-off yesterday, hitting a daily low of $100,372 on Binance crypto exchange. However, recent on-chain data suggests the price slump may persist, as BTC miners continue transferring coins to exchanges at unprecedented levels.

Bitcoin Miners-To-Exchange Transfers Hit Record High

According to a recent CryptoQuant Quicktake post by contributor CryptoOnchain, the total realized inflow from Bitcoin miners to exchanges has surged to historic highs. This spike likely contributed to the recent price tumble from the mid-$100,000 range.

For the uninitiated, Bitcoin miners’ total realized inflow to exchanges measures the actual amount of BTC that miners have transferred from their wallets to cryptocurrency exchanges. A sharp rise in this metric typically signals that miners are selling more of their holdings, which can increase supply in the market and potentially drive prices down.

CryptoOnchain shared the following chart showing miners’ inflows surpassing $1 billion per day between May 19 and May 28, 2025. If this trend continues, BTC could face a deeper correction, potentially falling into the low $90,000 range.

A similar trend was observed earlier this year in January when BTC was in the midst of a historical rally, creating multiple new all-time highs (ATH) in quick succession. At the time, BTC miners offloaded close to 140,000 coins for roughly $13.72 billion.

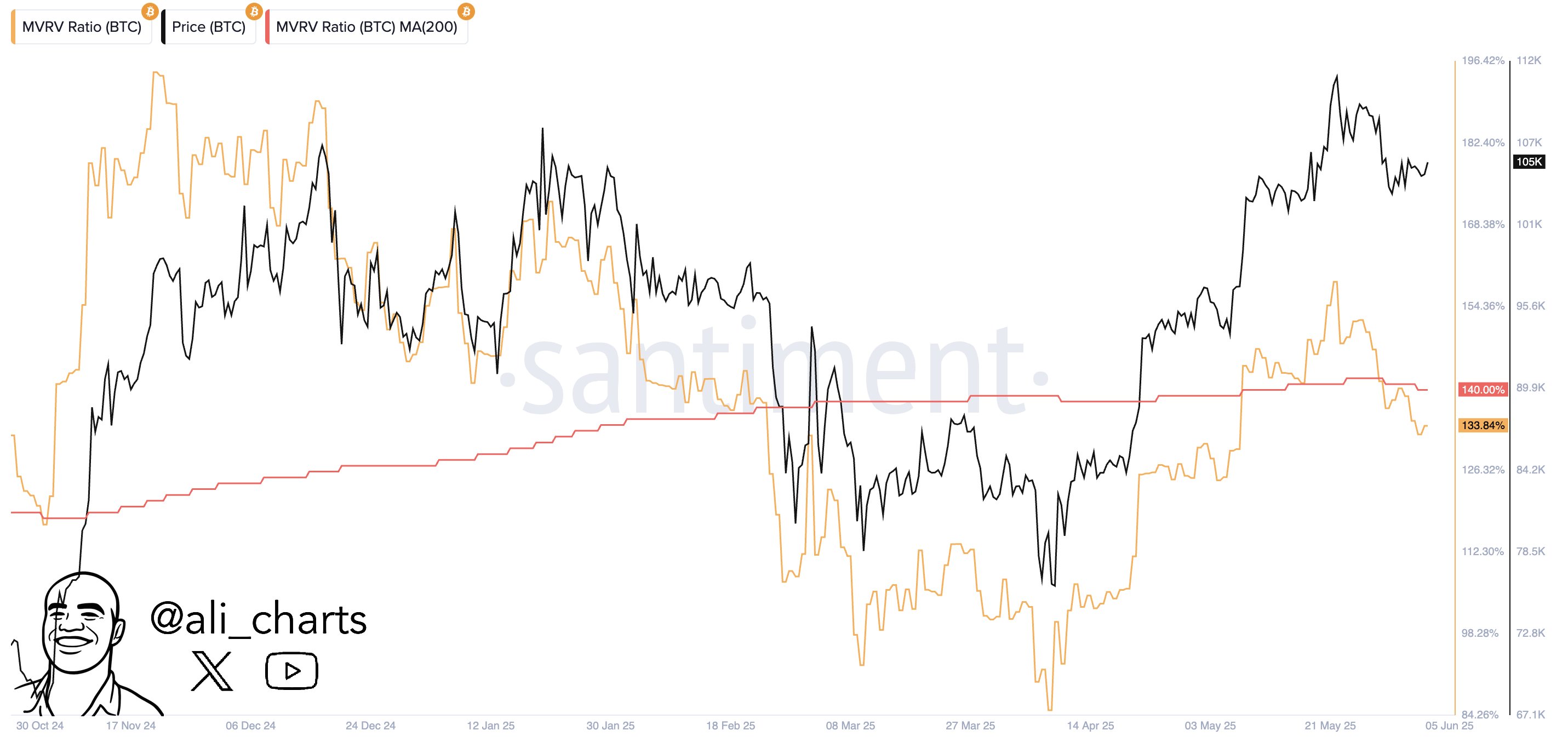

Meanwhile, seasoned crypto analyst Ali Martinez pointed out another bearish signal. In an X post, he noted that the Bitcoin Market Value to Realized Value (MVRV) ratio has fallen below its 200-day simple moving average (SMA) – a sign that may lead to further selling pressure.

When the MVRV ratio falls below its 200-day SMA, it suggests that the average market participant is holding Bitcoin at a loss or near break-even. This often indicates bearish sentiment or undervaluation, which can trigger further selling among small investors.

BTC Holders Cautiously Optimistic

Adding to the rising uncertainty, yesterday’s public feud between US President Donald Trump and Elon Musk further dampened market sentiment. Some analysts now predict BTC could fall as low as $96,000.

Fellow crypto analyst Anup Ziddi made a similar bearish forecast. The analyst recently stated that as long as BTC remains below $107,000, its chances of further crashes will remain elevated.

That said, there are still reasons for cautious optimism. Recent on-chain data shows that new Bitcoin whales are aggressively accumulating the asset, reinforcing the potential for a future supply squeeze. At press time, BTC is trading at $104,963, up 0.2% in the past 24 hours.

Content Original Link:

" target="_blank">