Why Crypto Is Going Down Today? Bitcoin, Ethereum, Dogecoin and XRP Prices Fall After CPI Read

A slightlycooler-than-expected U.S. inflation reading initially boosted cryptocurrencyprices but ultimately led to a market correction.

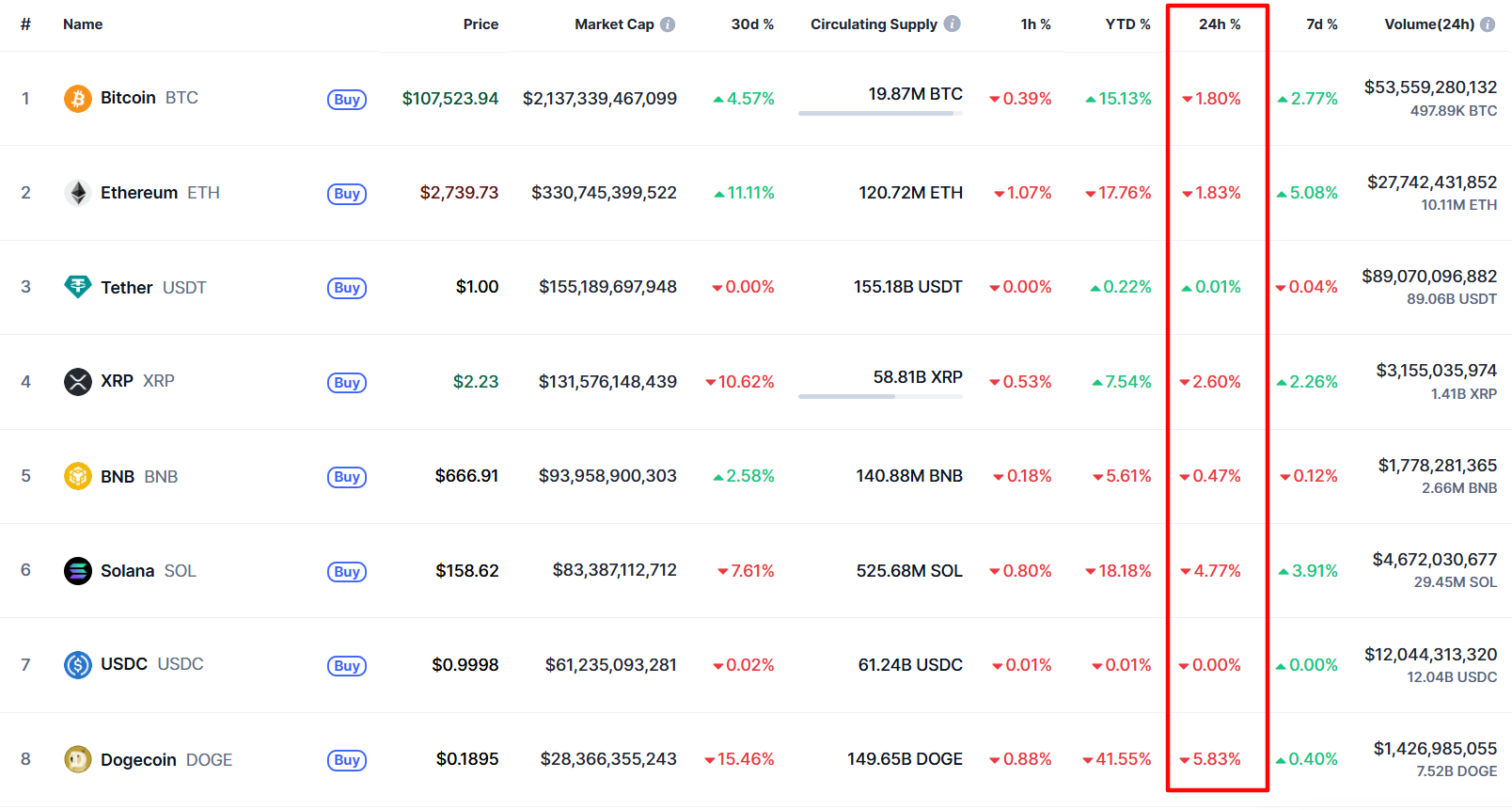

In effect,the cryptocurrency market continues to navigate turbulent waters in June 2025,with major digital assets experiencing significant price movements amidshifting macroeconomic conditions. Bitcoin price fluctuations, Ethereum pricevolatility, XRP price corrections, and Dogecoin price swings have capturedretail traders' attention as they seek to understand the underlying factorsdriving these market dynamics.

Why is crypto down? This article explores the key factors behind the recent marketdecline, while also presenting the latest expert price predictions and insightsfrom a technical analysis.

The cryptolandscape has shown mixed signals during the last 24-hour window. Bitcoinprice initially surged above $110,000 following cooler-than-expected U.S.Consumer Price Index (CPI) data, but subsequently retreated to close at$106,687, marking a 1.4% decline. The flagship cryptocurrency continues tradingaround $107,634 as of Thursday, maintaining its position as the market leaderdespite ongoing volatility Volatility In finance, volatility refers to the amount of change in the rate of a financial instrument, such as commodities, currencies, or stocks, over a given time period. Essentially, volatility describes the nature of an instrument’s fluctuation; a highly volatile security equates to large fluctuations in price, and a low volatile security equates to timid fluctuations in price. Volatility is an important statistical indicator used by financial traders to assist them in developing trading systems. Trad In finance, volatility refers to the amount of change in the rate of a financial instrument, such as commodities, currencies, or stocks, over a given time period. Essentially, volatility describes the nature of an instrument’s fluctuation; a highly volatile security equates to large fluctuations in price, and a low volatile security equates to timid fluctuations in price. Volatility is an important statistical indicator used by financial traders to assist them in developing trading systems. Trad Read this Term.

Ethereumprice action has been similar, with ETH testing the $2,878 level on Wednesday, itshighest point in several months, before closing 1.6% lower at $2,720. Thesecond-largest cryptocurrency by market capitalization is currently tradingnear $2,750, representing a 0.8% decline as it struggles to maintain momentumabove key resistance levels.

XRP pricehas faced consistent selling pressure, declining for three consecutive days andcurrently trading at $2.23, down 1.4%. Despite briefly touching $2.3368 duringWednesday's session, a two-week high, the token has failed to sustain itsbullish momentum amid ongoing regulatory uncertainty.

Dogecoinprice mirrors the broader market sentiment, initially rising above $0.20 beforeclosing Wednesday's session with a 2.5% loss at $0.1934. The memecryptocurrency continues its decline, falling an additional 1.5% to $0.19 onThursday.

Why Is Crypto Down? MixedImpact of U.S. CPI Reading

The primarycatalyst stems from stalled U.S.-China trade negotiations, with TreasurySecretary Scott Bessent's confirmation dampening investor sentiment andtriggering risk-off behavior globally.

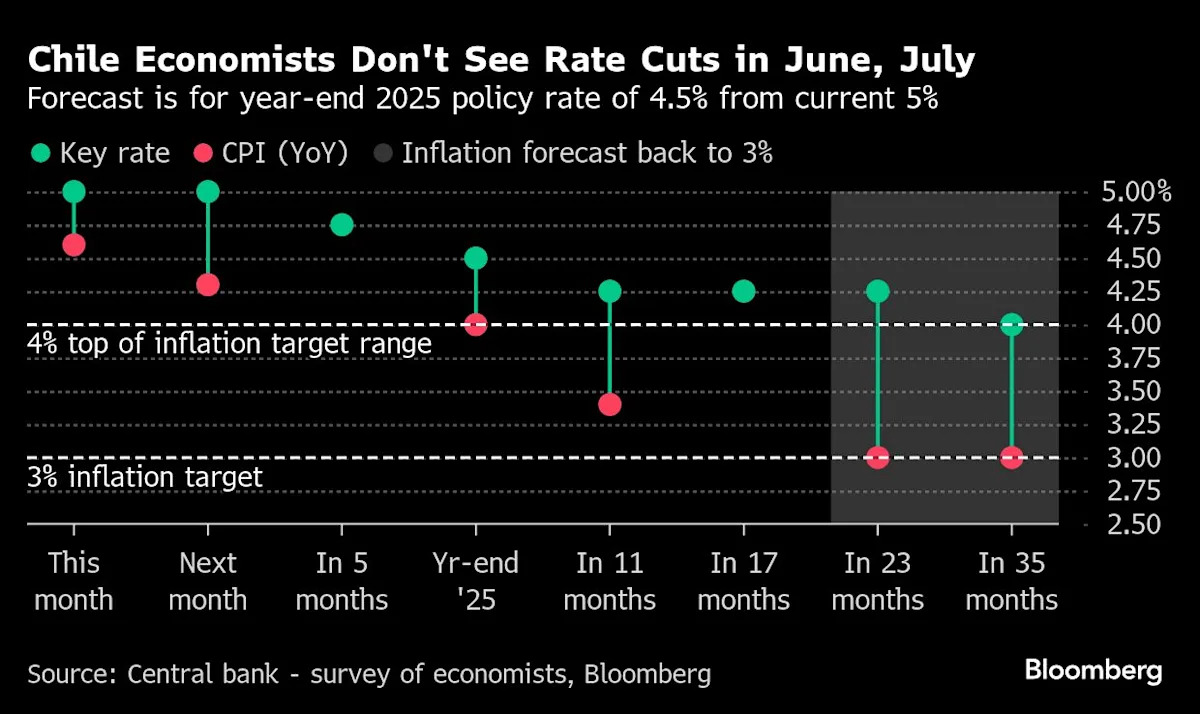

The U.S.inflation reading released on Wednesday also played a role. Although thecryptocurrency market initially reacted positively to the Consumer Price Index(CPI) report, showingannual inflation at 2.4%, slightly below the expected 2.5%, investorsremain cautious due to ongoing concerns over the growing debt burden of theU.S. government.

“Thelatest U.S. CPI data has been published and came in slightly cooler thanexpected, giving the market some optimism that inflation might be easing,” Dr.Kirill Kretov from CoinPanel explains the current market dynamics. “However,macroeconomic uncertainty is still high. With the market's thin liquidity, evenmoderate players with enough capital could easily move prices againstexpectations.”

Massiveliquidations have amplified the downward pressure, with over $683.4 million incrypto futures liquidated within 24 hours. Long positions accounted for $617.85million of these liquidations, demonstrating the extent of overleveragedbullish positions in the market.

Technicalbreakdown occurred as the total crypto market capitalization broke below thecritical $3.35 trillion support level. This technical failure triggeredalgorithmic selling and stop-loss orders, creating additional downward momentumthat affected all major cryptocurrencies.

Bitcoin Price Predictions:Expert Analysis and Forecasts

Bitcoinprice predictions for June 2025 remain cautiously optimistic despite recentvolatility. Leading analysts suggest a trading range between $100,000 and$120,000 as BTC consolidates above key exponential moving averages whilemaintaining its bullish long-term structure.

Multipleforecasting models present varying scenarios for Bitcoin Bitcoin While some may still be wondering what is Bitcoin, who created Bitcoin, or how does Bitcoin work, one thing is certain: Bitcoin has changed the world.No one can remain indifferent to this revolutionary, decentralized, digital asset nor to its blockchain technology.In fact, we’ve gone a long way ever since a Florida resident Laszlo Hanyecz made BTC’s first official commercial transaction with a real company by trading 10,000 Bitcoins for 2 pizzas at his local Papa John’s.One could now argue that While some may still be wondering what is Bitcoin, who created Bitcoin, or how does Bitcoin work, one thing is certain: Bitcoin has changed the world.No one can remain indifferent to this revolutionary, decentralized, digital asset nor to its blockchain technology.In fact, we’ve gone a long way ever since a Florida resident Laszlo Hanyecz made BTC’s first official commercial transaction with a real company by trading 10,000 Bitcoins for 2 pizzas at his local Papa John’s.One could now argue that Read this Term's trajectory. Bitfinexanalysis targets $115,000 by early July 2025 in bullish scenarios, while TomLee from Fundstrat presents perhaps the most aggressive outlook, targeting$150,000 to $250,000 by year-end.

Thesupply-demand dynamics supporting these projections remain compelling. Bitwiseresearch indicates that 95% of all Bitcoin has been mined, yet 95% of the worlddoesn't own Bitcoin. This massive imbalance suggests enormous potential forprice appreciation as adoption accelerates.

Changelly'stechnical analysis forecasts Bitcoin reaching $123,000, representing a 12%increase from current levels.

Ethereum Price Outlook AndSummer Rally Expectations

Ethereumprice predictions for June 2025 indicate potential recovery toward the$2,800–$2,900 zone if bullish momentum revives mid-month. Downside riskpersists to $2,280, especially if macro sentiment weakens further.

However, mytechnical analysis indicates that Ethereum has managed to break out of theconsolidation range that persisted between May and June, with the upperboundary near $2,730. This breakout suggests that, from a medium-termperspective, the cryptocurrency may have room for further gains.

“Asmall positive for cryptocurrencies as the CPI data was just below expectations,”Paul Howard from Wincent provides measured commentary. “We can confidently saywe expect a continued sideways movement in digital asset prices for the shortterm, with expectation prices edge higher over the summer and beyond.”

Analystsexpect summer months to bring increased trading activity, further supportingETH price predictions. In July 2025, Ethereum is likely to hover between $2,900and $3,000, nearing the psychological $3,000 mark.

XRP, Dogecoin And AltcoinMarket Dynamics

XRP pricefaces critical catalysts in June 2025, with the Ripple lawsuit outcome expectedon June 16 serving as a major market driver. If the legal proceedings endfavorably with manageable penalties or clear regulatory distinction for XRP,analysts anticipate renewed buying pressure.

Currentforecasts suggest XRP could break above $0.65 and rally toward $0.80 or higherin favorable scenarios. However, negative court or regulatory news could pushthe token down to primary support around $0.45.

You may also like:XRP's Weekend Gain and Bullish Flag Pattern Support 50% Jump Prediction

From a technicalstandpoint, Dogecoin appears to be the weakest among major cryptocurrencies.The $0.25 level is acting as strong resistance, while a downward trendlinecontinues to push the price lower. As a result, a move toward the $0.15 areanow seems more likely.

Crypto News, FAQ

Why Is Crypto Down Now?

Thecryptocurrency market is experiencing downward pressure in June 2025 due toseveral interconnected factors creating a perfect storm of selling sentiment.Stalled US-China trade negotiations have emerged as the primary catalyst, withTreasury Secretary Scott Bessent confirming that talks are “a bitstalled,” triggering risk-off behavior among investors. This geopoliticaluncertainty has historically impacted cryptocurrency prices due to their strongcorrelation with risk assets.

Why Is the Crypto MarketFalling?

The cryptomarket's current decline reflects a combination of macroeconomic uncertaintyand reduced investor demand. Bitcoin's bearishness follows waning demand afterits run to all-time highs above $111,000, with demand metrics reaching levelshistorically associated with market tops. Bitcoin's 30-day demand growthreached 229,000 BTC on May 28, near the previous demand growth peak of 279,000BTC that marked the market top in December 2024.

Will Crypto Rise Again?

Yes,historical patterns and fundamental analysis strongly suggest crypto willrecover and rise again in 2025. The cryptocurrency market has demonstratedremarkable resilience through previous crashes in 2013, 2018, and 2022, eachtime emerging stronger and more mature. Several factors support a bullishrecovery outlook for the remainder of 2025.

Is It Still WorthInvesting in Crypto?

Yes, itremains worth investing in cryptocurrency, but with important caveats regardingrisk management and portfolio allocation. 73% of U.S. crypto holders plan tocontinue investing in cryptocurrency in 2025, signaling strong long-termconfidence in the market. This trend spans across income levels, with bothhigher-income and lower-income groups citing established coins as the mostappealing investment option.

Content Original Link:

" target="_blank">