Bitcoin: ETFs See A Fifth Consecutive Day Of Inflows Despite Geopolitical Uncertainties

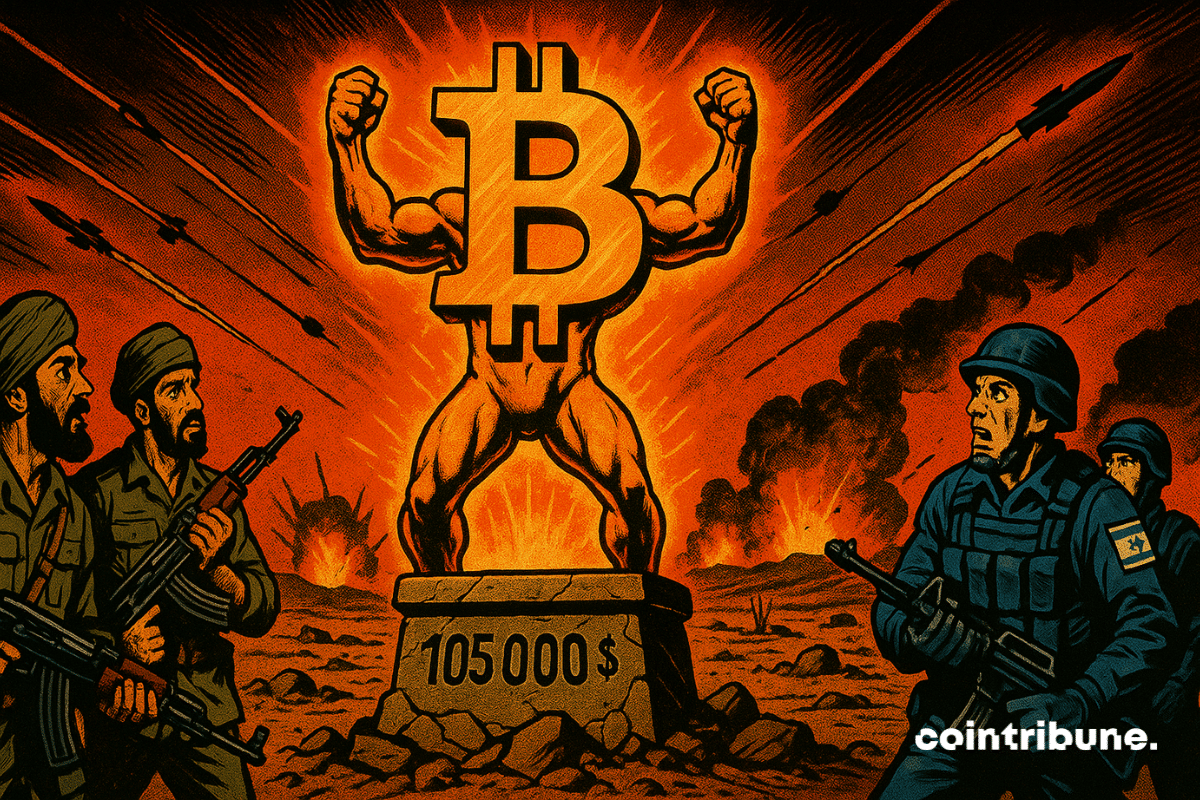

The world is wavering, but bitcoin is holding strong. While missiles rain down in the Middle East and traditional markets hold their breath, an almost surreal dynamic is unfolding: investors are pouring billions into Bitcoin ETFs. Normally, so-called “risky” assets flee at the slightest geopolitical shake-up. But here, it’s the opposite. It seems bitcoin is changing its status: from speculative asset to emerging safe haven. This metamorphosis, very real, is rooted in a series of recent events that would be unwise to ignore.

In Brief

- Over $1.3 billion invested in Bitcoin ETFs in five days, despite geopolitical tensions.

- Bitcoin remains stable around $105,000, close to its ATH, despite Israel-Iran strikes.

- Amid global instability and dollar decline, bitcoin asserts itself as an emerging safe haven.

The Quiet Strength of Bitcoin Amid the Storm

What should have derailed the market has, against all odds, strengthened bitcoin’s appeal. Since June 9th, ETFs backed by the digital asset have experienced five consecutive days of net inflows, totaling over $1.3 billion. Figures that slap those who predicted capital flight in case of conflict.

During the same period, bitcoin has lost only a modest 3% following the announcement of Israeli strikes against Iran. It then rebounded almost immediately, settling around $105,000. Simply put: less than 6% from its all-time high, bitcoin continues to intrigue. Not because of its rise, but due to its resilience. An asset that does not succumb to panic attracts attention.

Behind this stability lies a broader mechanism: the loss of confidence in the dollar. The DXY index plunged below 100 points, a level it had not visited in over three years. The Dow Jones lost 600 points. Historically, when the greenback stumbles, bitcoin rallies. Two opposing forces, almost symmetrical. A kind of monetary waltz that bitcoin seems to master the rhythm of.

ETFs: Gateways to a Post-Dollar World

Just a few years ago, betting on bitcoin during a geopolitical crisis would have been considered mild madness. Today, institutional investors themselves are taking the plunge through ETFs. Why? Because they offer simplified, regulated exposure, and above all, compatibility with traditional financial structures. No need for complex wallets or cold storage: everything happens within traditional portfolios. And that changes everything.

Even tensions around the Strait of Hormuz, a passage for 20% of the world’s oil, are no longer enough to reverse the tide. Certainly, closure of the strait would trigger an energy price surge and could shake markets in the short term.

But in the long term, this kind of shock strengthens the bitcoin narrative: an asset decoupled from supply chains, insensitive to monetary policies, and resolutely outside the system.

ETFs, by facilitating this access, contribute to a silent transformation. They turn bitcoin into a hedge tool against inflation, uncontrolled sovereign debt, and even armed conflicts. It’s no longer a technological rebellion; it’s insurance against chaos.

Bitcoin Is No Longer a Bet. It’s a Positioning

What this sequence reveals is less bitcoin’s strength and more the widespread doubt about the foundations of the current economic system. A state can falter, a bank can fall, but the Bitcoin protocol remains unchanged. In a world saturated with uncertainties, this algorithmic predictability becomes an asset.

As tensions intensify—whether geopolitical, economic, or monetary—bitcoin gains ground. Not as an obvious choice, but as a necessity. The goal is no longer to beat the market but to protect oneself from it.

Therefore, it’s no surprise to see billions flowing into Bitcoin ETFs while the cannons roar. It’s not a paradox. It’s a signal. The financial world is sending a clear message: the time of doubt has passed, the turning point has begun, and BTC could capture $30 trillion of the US bond market.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Join the program

Fascinated by Bitcoin since 2017, Evariste has continuously researched the subject. While his initial interest was in trading, he now actively seeks to understand all advances centered on cryptocurrencies. As an editor, he strives to consistently deliver high-quality work that reflects the state of the sector as a whole.

Content Original Link:

" target="_blank">