Bitcoin (BTC) Price Prediction: Bitcoin Scarcity Could Push BTC to $1M, Says Top Investor

With Bitcoin trading above $118,000 and consolidating below its recent peak, long-term investors are turning their focus to BTC’s core feature—scarcity. Prominent market voices argue that Bitcoin’s capped supply, combined with increasing monetary debasement, could set the stage for a dramatic rally over the next decade.

Market Overview: Bitcoin’s Price Holds Steady While Consolidating

According to the latest Bitcoin technical analysis, BTC is stuck between $116,000 and $120,000, forming a tight consolidation pattern. Analysts say this could be a pause before a bigger trend move.

The Bitcoin RSI indicator on the daily chart reads 65, still in bullish territory. However, the MACD recently turned negative, suggesting near-term caution.

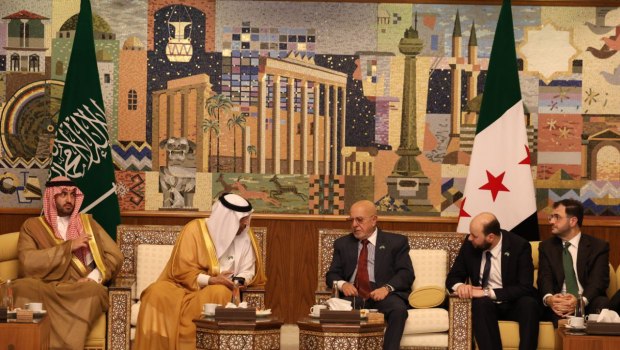

Analyst James Check expects Bitcoin to exceed $200,000 within five years but does not anticipate reaching that level in the current year. Source: @ImCryptOpus via X

Glassnode’s lead analyst, James Check, recently pointed out that Bitcoin may struggle to reach the $200,000 mark this year due to weak buying volume, emphasizing that such a move would require a significant uptick in market participation before he considers taking on additional risk.

Bitcoin Scarcity: A Driving Force Behind Long-Term Bullish Predictions

The case for Bitcoin hitting $1 million rests heavily on its fixed supply of 21 million coins—with far fewer actually circulating due to lost wallets and long-term holders.

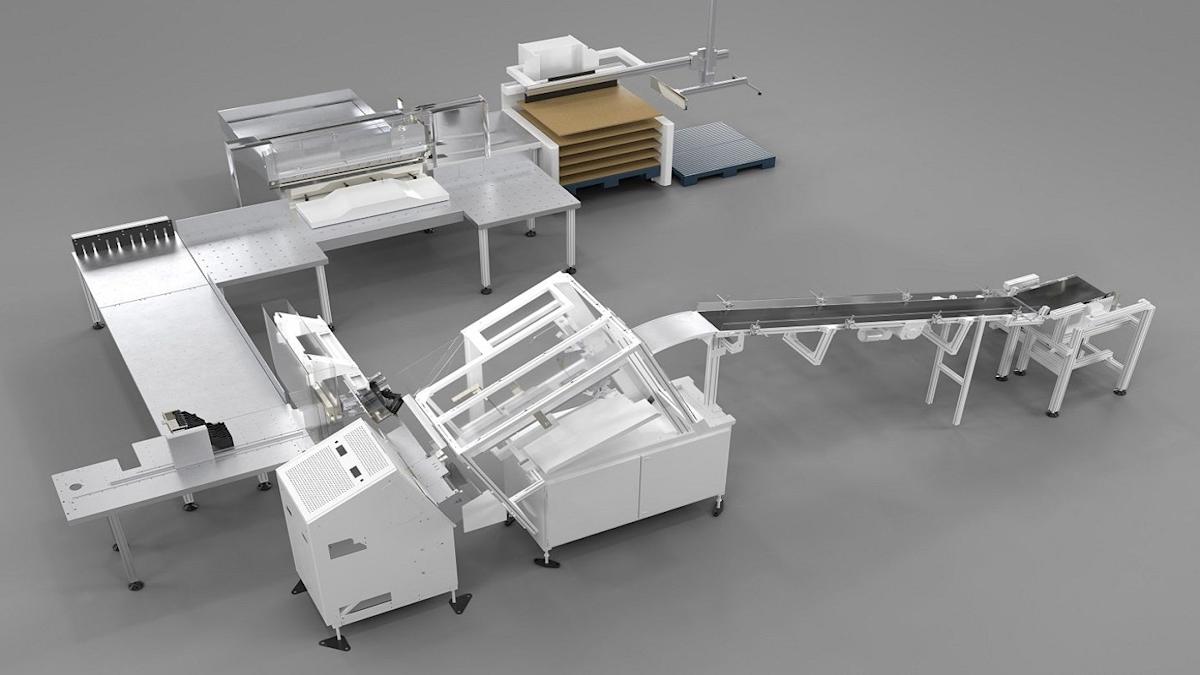

Bitcoin poised for breakout as scarcity rises and fiat returns lag behind—history hints at a parabolic uptrend ahead. Source: ZenTradesRW on Tradingview

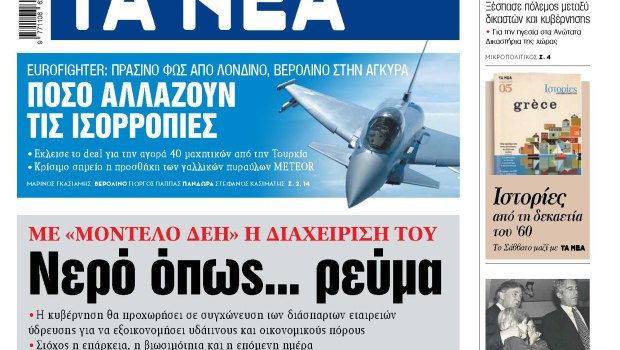

Investor Fred Krueger underscored the scarcity narrative, explaining that pushing Bitcoin to $1 million would require just $1 trillion in capital—an amount he considers modest compared to the projected expansion of the global money supply. With global liquidity expected to double from $100 trillion to $200 trillion by 2035, analysts argue that fiat currency devaluation is making BTC increasingly attractive.

Data from River, a Bitcoin-focused platform, reveals that investors who held BTC since July 2024 have outperformed fiat currency returns tenfold, reinforcing Bitcoin’s growing appeal as an inflation hedge.

Additionally, the global M2-per-Bitcoin ratio—a metric comparing global money supply to the total BTC supply—has reached a 12-year high of $5.7 million, highlighting the asset’s increasing scarcity against fiat expansion.

Expert Insights: From $200K to $1M—The Roadmap for Bitcoin

While $1M Bitcoin remains a long-term target, several respected analysts forecast $200,000 by the end of 2025. Bitwise CIO Matt Hougan, Bernstein Research, and analyst apsk32 both highlight a combination of institutional demand and supply shock triggered by Bitcoin halving 2025 and growing ETF inflows.

“Expecting $200,000+ Bitcoin in Q4,” said apsk32, citing historical cycle patterns and the power curve trendline model.

Reaching $1 million per Bitcoin would require $1 trillion in inflows—just 1% of the global money supply, which is projected to double to $200 trillion by 2035. Source: Fred Krueger via X

Meanwhile, JPMorgan and other institutions continue to explore crypto-backed financial products, and corporate treasuries are stacking BTC, which supports the notion of Bitcoin as a reserve asset.

Despite this optimism, James Check cautioned that rapid price gains without structural support can lead to just-as-rapid corrections: “You need follow-through; otherwise, you’re trading through air.”

Looking Ahead: Is a $1M Bitcoin Still a Moonshot—or Just a Matter of Time?

The long-term Bitcoin forecast remains highly bullish, underpinned by macroeconomic shifts, increased institutional interest, and Bitcoin’s programmatic scarcity. While short-term resistance and volume weakness are valid concerns, many investors are focusing on the bigger picture.

Bitcoin (BTC) was trading at around $118,579, up 0.64% in the last 24 hours at press time. Source: Bitcoin Liquid Index (BLX) via Brave New Coin

In the words of early BTC advocate Davinci Jeremie, what was once a bold call to “buy $1 of Bitcoin” has evolved into a broader thesis: Bitcoin’s journey to $1 million may no longer be fantasy—it could be financial inevitability.

As the market enters its next phase, all eyes will be on the charts, the institutions, and the calendar as Bitcoin halving 2025 draws closer.

Content Original Link:

" target="_blank">