Best CD rates today, June 22, 2025 (lock in up to 4.4% APY)

Find out how much you could earn by locking in a high CD rate today. A certificate of deposit (CD) allows you to lock in a competitive rate on your savings and help your balance grow. However, rates vary widely across financial institutions, so it’s important to ensure you’re getting the best rate possible when shopping around for a CD. The following is a breakdown of CD rates today and where to find the best offers.

Overview of CD rates today

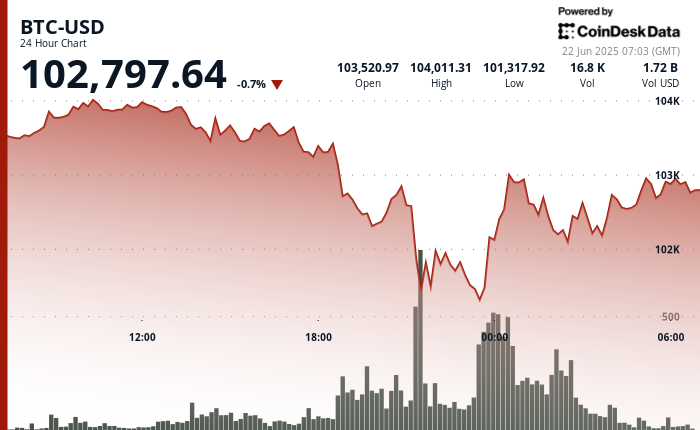

Historically, longer-term CDs offered higher interest rates than shorter-term CDs. Generally, this is because banks would pay better rates to encourage savers to keep their money on deposit longer. However, in today’s economic climate, the opposite is true.

As of June 22, 2025, the highest CD rate is 4.4% APY, offered by Western Alliance Bank on its 3-month CD. There is a $1 minimum opening deposit required.

This embedded content is not available in your region.

How much interest can I earn with a CD?

The amount of interest you can earn from a CD depends on the annual percentage rate (APY). This is a measure of your total earnings after one year when considering the base interest rate and how often interest compounds (CD interest typically compounds daily or monthly).

Say you invest $1,000 in a one-year CD with 1.81% APY, and interest compounds monthly. At the end of that year, your balance would grow to $1,018.25 — your initial $1,000 deposit, plus $18.25 in interest.

Now let’s say you choose a one-year CD that offers 4% APY instead. In this case, your balance would grow to $1,040.74 over the same period, which includes $40.74 in interest.

The more you deposit in a CD, the more you stand to earn. If we took our same example of a one-year CD at 4% APY, but deposit $10,000, your total balance when the CD matures would be $10,407.42, meaning you’d earn $407.42 in interest.

Read more: What is a good CD rate?

Up next

Types of CDs

When choosing a CD, the interest rate is usually top of mind. However, the rate isn’t the only factor you should consider. There are several types of CDs that offer different benefits, though you may need to accept a slightly lower interest rate in exchange for more flexibility. Here’s a look at some of the common types of CDs you can consider beyond traditional CDs:

-

Bump-up CD: This type of CD allows you to request a higher interest rate if your bank's rates go up during the account’s term. However, you’re usually allowed to "bump up" your rate just once.

-

No-penalty CD: Also known as a liquid CD, type of CD gives you the option to withdraw your funds before maturity without paying a penalty.

-

Jumbo CD: These CDs require a higher minimum deposit (usually $100,000 or more), and often offer higher interest rate in return. In today’s CD rate environment, however, the difference between traditional and jumbo CD rates may not be much.

-

Brokered CD: As the name suggests, these CDs are purchased through a brokerage rather than directly from a bank. Brokered CDs can sometimes offer higher rates or more flexible terms, but they also carry more risk and might not be FDIC-insured.

This embedded content is not available in your region.

Content Original Link:

" target="_blank">