Nvidia: How the chipmaker evolved from a gaming startup to an AI giant

Finding growing success in supplying GPUs to both customers and consoles like Xbox, Nvidia joined the Nasdaq 100 and the S&P 500 in 2001.

In 2006, Nvidia launched CUDA, a platform that allowed users to access their GPUs’ parallel processing capabilities to run their own software instead of just graphics. Between 2006 to 2017, Nvidia invested nearly $12 billion in research & development with a large portion of those funds going towards CUDA.

CUDA downloads slowed entering the 2010s, and while CUDA provided users with the ability to use chips for purposes other than gaming, it didn’t initially seem to pay off for investors.

“Some investors were big Nvidia fans in the late 2000s and gave them the benefit of the doubt for the first five years of the CUDA investment," Acquired podcast co-host Ben Gilbert said in a 2022 episode. "But in the mid-2010s, market demand still wasn't showing up in a big way, and it was becoming a bigger and bigger investment."

However, later technological developments would make CUDA crucial to the company.

"It made all of our products more expensive since we were selling these gamer cards while putting computing acceleration into them," Bryan Catanzaro, Nvidia's vice president of applied deep learning research, told Yahoo Finance in 2023. "It took a lot of commitment to follow through. … I would say it was about 10 years before Wall Street really started to believe this investment was worth anything."

'Destiny meets serendipity'

In 2012, students Alex Krizhevsky and Ilya Sutskever used CUDA to train the visual-recognition neural network AlexNet with two Nvidia GPUs.

AlexNet’s breakthrough performance in identifying images demonstrated that using GPUs to train machine learning models cut training times significantly compared to the CPUs that were previously used.

Following this advancement, Nvidia began pivoting its focus to artificial intelligence, supported by its revenue from gaming. By 2016, it announced the DGX-1, a system designed specifically for deep learning and the large language models that were on the rise. That year, Nvidia stock nearly tripled in price.

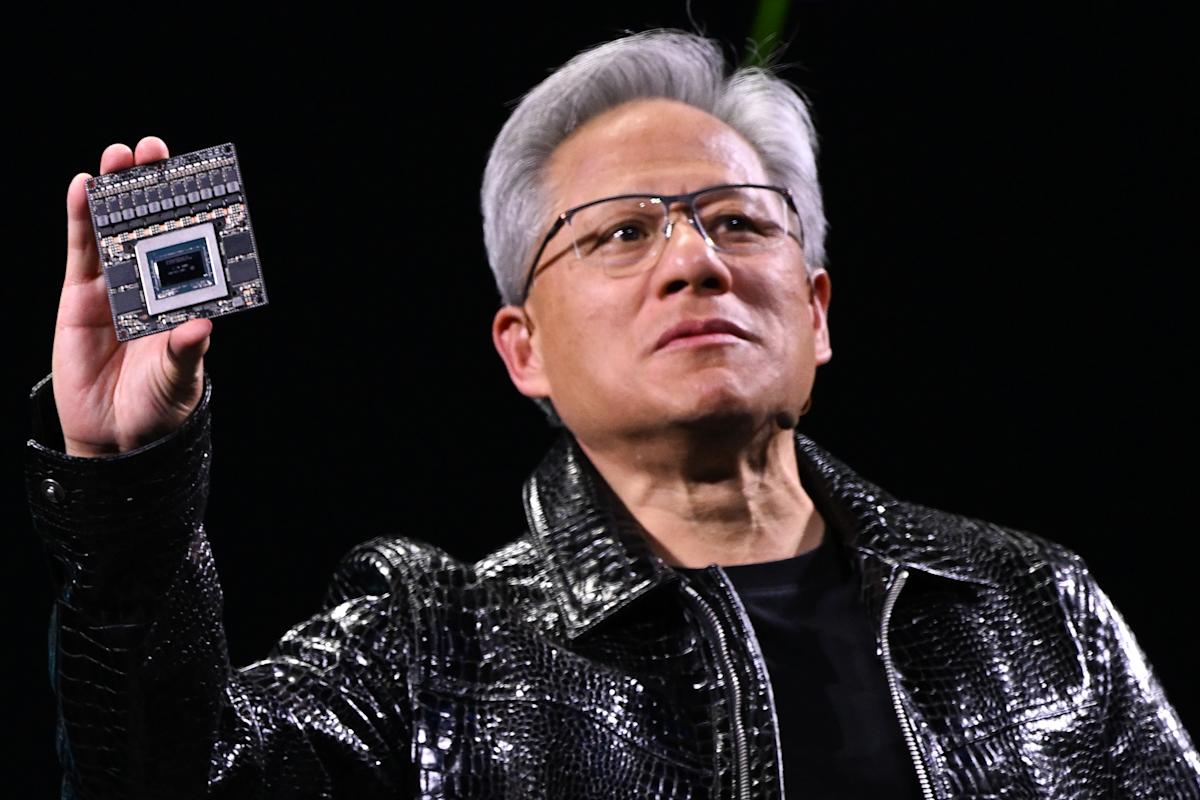

“It’s ‘destiny meets serendipity,’” Nvidia CEO Jensen Huang told Yahoo Finance at the time. “People think it’s an overnight success, but like most overnight successes, it took us years.”

At the same time, Nvidia took the opportunity to make strategic acquisitions, such as wireless company Icera in 2011 and hardware company The Portland Group in 2013. It tried to acquire the semiconductor and design company Arm (ARM) in 2020, but the deal ultimately fell through after regulatory concerns.

In March 2022, Nvidia announced the H100 “Hopper” chip, promising faster training and better performance for artificial intelligence. Controlling a significant majority of the market share with this GPU, major companies, including Alphabet (GOOG), Amazon (AMZN), and Microsoft (MSFT), turned to Nvidia with billions as they began to develop AI and data-driven products.

One such company is OpenAI (OPAI.PVT), whose relationship with Nvidia stretches back to 2016, when Nvidia donated the first DGX-1 supercomputer to the startup. In November 2022, OpenAI launched ChatGPT, a language model built on Nvidia GPUs that quickly reached headlines.

In less than two months, ChatGPT set the record for the fastest-growing consumer application in history, according to a UBS study, reaching 100 million monthly active users in January 2023.

"A new computing era has begun," Nvidia CEO Jensen Huang said in a 2023 statement. "Companies worldwide are transitioning from general-purpose to accelerated computing and generative AI."

The road to $3 trillion

With investors increasingly interested in artificial intelligence and as the demand for GPUs to run models continues to grow, Nvidia’s revenue for the quarter ending in January 2024 more than doubled its results year over year.

Following the quarterly report’s release, Nvidia had the largest one-day gain in stock market history, adding $277 billion in value. It then hit a valuation of $2 trillion the following day. The record wouldn’t stand for long, however; Nvidia beat it again just two months later.

That March, Nvidia announced its next chip: Blackwell. Offering higher performance with reduced cost and energy consumption, the chips were designed to work better than previous versions when linked to work together in large numbers.

Soon after, Nvidia announced a 10-for-1 stock split in June 2024. Following the split, it passed Microsoft and Apple (AAPL) to become the world’s most valuable company at $3.3 trillion. By November 2024, it was added to the Dow Jones Industrial Average.

Despite its successes, Nvidia also encountered challenges throughout its rise. In 2018, it faced a class-action lawsuit alleging it did not properly disclose to investors the impact of the cryptocurrency market on revenue from sales of GPUs.

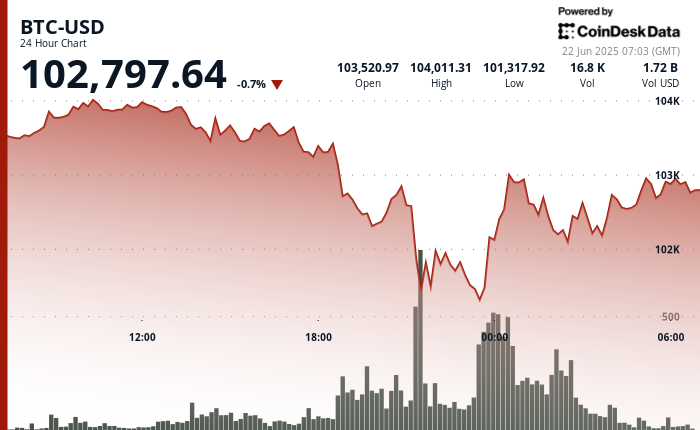

At the time, “miners” of cryptocurrencies such as bitcoin (BTC-USD) and ethereum (ETH-USD) used the GPUs to complete transactions and secure new crypto tokens. The process requires significant computational power, which made Nvidia GPUs a popular choice. Nvidia paid a $5.5 million settlement in 2022 to the SEC because of the issue, and in December 2024, the Supreme Court dismissed Nvidia’s appeal, allowing the 2018 case to proceed.

This wasn’t Nvidia’s first time managing legal issues regarding its chips. In 2016, it settled a case involving the marketed performance and actual capabilities of its GTX 970, with payouts of $30 per purchase.

On top of legal issues, there is also the challenge of supply keeping up with demand. A global chip shortage first occurred in early 2020 as a result of the coronavirus pandemic and an increased reliance on technology for remote work. Other factors that lengthened the shortage through 2023 included the initial US-China trade war, severe weather events, and the Russia-Ukraine war.

A December 2024 report from the IDC projected global demand for AI and high-performance computing (HPC) to grow by over 15% in 2025.

Getting the AI revolution 'going'

President Trump announced Project Stargate in January 2025, which involves tech companies such as Oracle (ORCL), OpenAI, and SoftBank (SFTBY) investing $500 billion in AI infrastructure in the United States over the next four years. Nvidia, as a technology partner to the project, saw a jump in its stock, and reached a $3.6 trillion market cap.

Later in the month, however, the Chinese company DeepSeek released its own AI model, which was reportedly trained at a significantly lower cost than that of competitors. Following the announcement, Nvidia stock dropped $589 billion, almost 17%, marking the largest single-day loss in stock market history.

Following the drop, March 2025 brought the debut of Nvidia's Blackwell Ultra, the successor to Blackwell. The new chip was announced to have 1.5 times the performance of the previous chip, which could help AI models answer queries faster.

In April 2025, Trump banned the export of the company’s H20 chip to China, as chips like Nvidia’s are critical in the race to develop AI technologies. In its first quarter report, Nvidia said it expects to miss $8 billion in potential sales because of the ban.

Despite the expanded limitations on exports, Nvidia continues to grow and even briefly passed Microsoft again in June as the world’s most valuable company. Looking forward, some even expect it could be the first company to hit a $4 trillion market cap.

“[Nvidia] really got the AI revolution going,” ARK Invest founder Cathie Wood told Yahoo Finance earlier this year, “and we think it's still going to play a mighty role."

Click here for the latest technology news that will impact the stock market

Read the latest financial and business news from Yahoo Finance

—

Nina is a data reporter intern for Yahoo Finance.

Content Original Link:

" target="_blank">