Oil prices expected to rise after US attack on Iran

Oil prices are expected to rise as the trading week starts, after the US attack on Iran stoked fears of an escalating regional conflict that could shut down the vital strait of Hormuz shipping route.

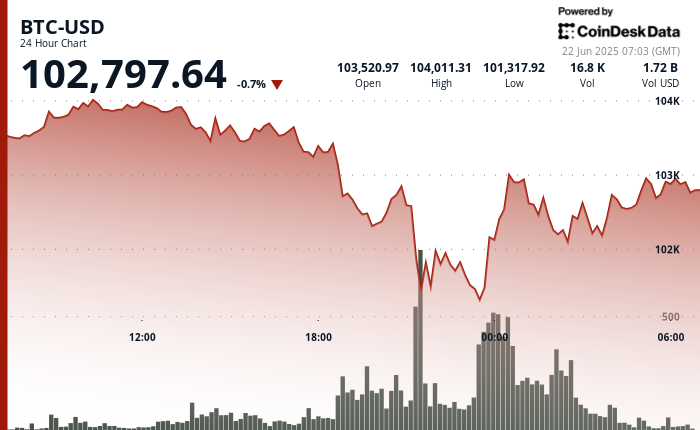

A barrel of Brent crude was selling for about $77 on Friday, having risen by more than 10% since mid-June when Israel’s attack on Iranian nuclear sites prompted missile strikes from Tehran against Tel Aviv.

Donald Trump’s decision to follow Israel in launching a US attack on Iran over the weekend could drive prices up by a further $5 when markets open, according to forecasts from oil market analysts.

Trading for the week begins at 11pm UK time on Sunday.

“An oil price jump is expected,” said Jorge Leon, the head of geopolitical analysis at the energy intelligence firm Rystad and a former official at Opec, the group of major oil-producing nations.

“In an extreme scenario where Iran responds with direct strikes or targets regional oil infrastructure, oil prices will surge sharply. Even in the absence of immediate retaliation, markets are likely to price in a higher geopolitical risk premium.”

Brent crude, the traditional benchmark global oil price, could gain $3 to $5 per barrel when markets open, Ole Hvalbye, an SEB analyst, said in a note.

The Wall Street bank JP Morgan has previously forecast that the oil price could rise as high as $130 in the event that a sustained Middle East conflict closes the strait of Hormuz.

Iranian officials have previously threatened to block the Strait, the conduit for a fifth of global oil consumption, if Tehran’s interests are threatened.

Any such retaliation could have huge knock-on effects for the global economy, with the resulting oil price shock risking a period of high inflation, as motorists pay more for petrol and the cost of transporting goods soars.

Brent crude settled at $77.01 a barrel on Friday, while the US West Texas Intermediate (WTI) benchmark was at $73.84.

Some analysts played down the risk of long-term disruption to shipping routes, pointing out that most of Iran’s oil exports to China pass through the strait of Hormuz.

If oil prices were to rise to $130, that would exceed levels reached in the aftermath of Russia’s invasion of Ukraine.

The all-time high for Brent crude is $147.50, set in July 2008 just before the global financial crisis sent prices plunging.

Content Original Link:

" target="_blank">