Seeking a Cure for Sickly Corporate Governance at SinoVac

On the other side, supporting the current board, is Chairman Chiang Li and his 1Globe Capital family office along with two investment firms, OrbiMed, and Heng Ren Partners. A company spokesperson also directed CorpGov to public statements already issued.

Unfortunately, the current board hasn’t made much progress towards unfreezing the shares – perhaps the most important short-term goal. Quite to the contrary, the board may have contributed to the resignation of its auditor, Grant Thornton, after announcing it was “assessing certain corporate actions taken by the former board of directors.” Grant Thornton said in a letter to SinoVac that one reason for its resignation was that the board’s announcement introduced “uncertainty” and it would not be able to sign off on the company’s 2024 financial statements.

For its part, the board has argued that Grant Thornton’s departure was unrelated to any of its action. A company filing cited Grant Thornton’s letter which stated that its “resignation was not the result of any disagreement with the [Company’s current board of directors], the Company or management.”

Regardless of which combination of factors triggered Grant Thornton’s departure, the loss of a top-tier firm may mean the company won’t find another major accounting firm to sign off on its numbers, putting the company’s listing in further jeopardy. “At this point, the board looks like it’s up to something,” an accounting expert who asked not to be named told CorpGov. “Other firms will be reluctant until that’s cleared up.”

Indeed, the current board may have lost broader credibility, according to Charles Elson, Founding Director, Weinberg Center for Corporate Governance at the University of Delaware. “It doesn’t reflect well on any board that would allow an auditor to resign – what’s worse is if a board precipitates the departure. That doesn’t seem to be in the interest of the company or shareholders – the fiduciary duty of the board,” Mr. Elson told CorpGov. “You have to ask if it was done to help the company or in the self-interest of the directors.”

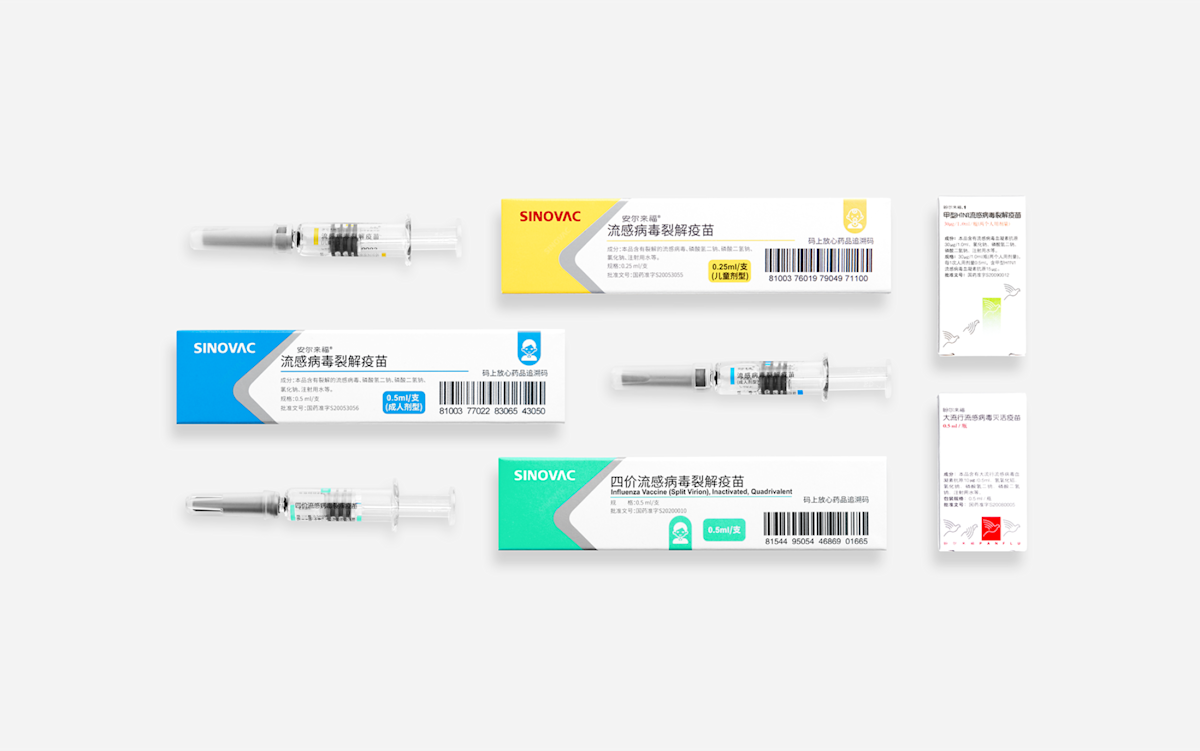

Professor Elson noted that the company has performed well with a highly successful drug and that its operations aren’t the concern at hand. “It goes beyond a performance issue and is a governance issue they are facing,” he said.

The current board has also been eroded down to just four members after multiple departures. One departee of note from that group is Pengfei Li, who was sentenced to prison after charges including embezzlement and forging government documents and seals apparently related to his attempt to seize control of a SinoVac subsidiary.

Interestingly, the challenger group isn’t trying to wipe out all existing directors. The slate actually includes two of the current four board members, Chiang Li, who is himself a major investor in the company, along with Yuk Lam Lo who was elected in a previous shareholder vote.

While a resumption of trading may be the best outcome for shareholders seeking liquidity, there is also discussion of a massive $55-a-share dividend, which would be welcome for those who have been waiting years without seeing a dime. It appears that both boards support that dividend and more, but discussion of it didn’t begin until recently when SAIF began making a stir. What’s more, there is no reason why the dividend couldn’t be paid before the July meeting – even if the shares remain halted.

Finally, it’s important to look at SinoVac as a successful company – well beyond Covid. The company had $440 million in sales in 2023, and $121 million in in the first half of 2024 (the business is highly seasonal and financials for the second half of 2024 have not yet been filed), with revenue coming from a variety of non-covid drugs and geographies. While the company’s cash value may be around $140 per share, the real job of the new board is to focus on getting the company focused on its operations – rather than fights and lawsuits. After so many years, investors who vote for board change may finally reap the rewards of SinoVac’s underlying success.

Contact:

The post Seeking a Cure for Sickly Corporate Governance at SinoVac appeared first on CorpGov.

Content Original Link:

" target="_blank">