Dollar Rethink Is Pushing Emerging World to Sell More Euro Debt

Strategists at Goldman Sachs Group Inc. compared euro- and dollar-denominated bonds sold by the same sovereign on the same day this year. They found that euro bonds slightly outperformed their benchmarks more than their dollar counterparts one week after issuance.

“The increase in euro-denominated bond issuance has generally been well absorbed by the market,” the bank’s strategists including Kamakshya Trivedi wrote in a report earlier this month.

The pickup in euro debt sales “is likely to extend given our outlook for less exceptional US growth and for further dollar depreciation,” they added.

Relative-value

Concerns over the US economy are also encouraging relative-value trades. Bank of America, for instance, likes betting on gains in Romania’s euro bonds due in 2044, paired with a bearish stance on the country’s dollar notes maturing the same year.

At JPMorgan, strategists see euro-denominated bonds from Poland, Morocco, Hungary and Mexico as the most compelling among their peers for investors switching out of dollar debt.

Overall appetite for emerging markets has been strong this year as investors grapple with US policy uncertainty, according to David Robbins, co-head of TCW Emerging Markets Group and a four-decade veteran of emerging markets.

“The relative yield advantage you’re getting in EM to what you’re getting in other markets continues to look attractive,” Robbins said.

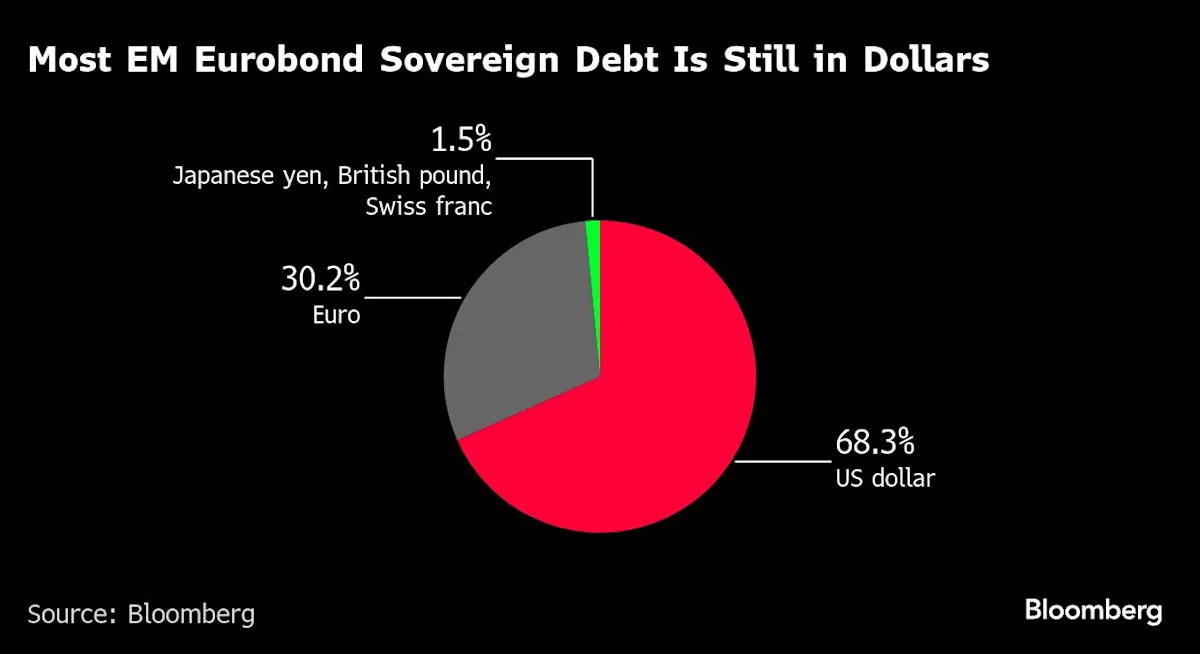

That has helped fuel debt sales across the board, with dollar-denominated issuance at the fastest pace since 2021. Diversification away from the greenback is unlikely to dent the dollar’s dominance in EM debt as those bonds are part of the JPMorgan’s EM benchmark bond index, and therefore make up a large chunk of investors’ portfolios.

As investors look for relative-value opportunities, borrowers with outstanding dollar debt may look to tap the euro market to diversify their funding sources, said Cathy Hepworth, head of emerging-market debt at PGIM.

Global EM-dedicated bond funds attracted $69 million in their 13th consecutive week of inflows as of July 16, sending this year’s total flows to $25.4 billion, Bank of America Corp. said, citing EPFR Global data.

Brazil — having already sold over $5 billion in dollar bonds this year — is reportedly keen to sell its first bonds in euro since 2014. Neighboring Colombia plans to issue euro-denominated bonds for the first time since 2016.

One of the two main administrative parts of Bosnia-Herzegovina is preparing to sell bonds on international markets for the first time, with a euro-denominated unsecured 5-year bond offering to follow. And Egypt officials are mulling selling hard-currency securities — including euro-denominated bonds — as part of issuance plans for the next 12 months.

“The dollar, for emerging markets, will always be the core funding currency,” JPMorgan’s Weiler said. But the “euro offers the biggest market depth as an alternative.”

What to Watch

-

South Africa, Brazil, Mexico will release inflation prints

-

Chile President Gabriel Boric will welcome progressive leaders for a summit in Santiago; Luiz Inacio Lula da Silva of Brazil and Gustavo Petro of Colombia are among those expected to attend

-

South Korea will publish GDP data

-

Central banks in Sri Lanka, Turkey, Nigeria hold monetary policy meetings

--With assistance from Kelsey Butler, Nicolle Yapur, Jorgelina do Rosario and Kerim Karakaya.

(Updates with bond flows in the 18th paragraph)

Most Read from Bloomberg Businessweek

-

A Rebel Army Is Building a Rare-Earth Empire on China’s Border

-

Thailand’s Changing Cannabis Rules Leave Farmers in a Tough Spot

-

Elon Musk’s Empire Is Creaking Under the Strain of Elon Musk

-

What the Tough Job Market for New College Grads Says About the Economy

©2025 Bloomberg L.P.

Content Original Link:

" target="_blank">